2022 off to good start as BMBI reports strong January sales

The latest figures from the Builders Merchant Building Index (BMBI), published in March, reveal builders’ merchants’ value sales in January 2022 were 24.1% up on the same month in 2021, the strongest year-on-year growth seen in recent months. However, it has been primarily driven by price inflation (+15.1%) rather than volume growth (+7.8%).

All bar one category sold more than the same month in the previous year with Renewables & Water Saving (+35.8%), Timber & Joinery Products (+31.5%), Landscaping (+28.9%) and Kitchens & Bathrooms (+28.8%) outperforming merchants generally. Seven categories grew more slowly including Heavy Building Materials (+21.4%), Plumbing, Heating & Electrical (+18.1%) and Tools (+13.3%).

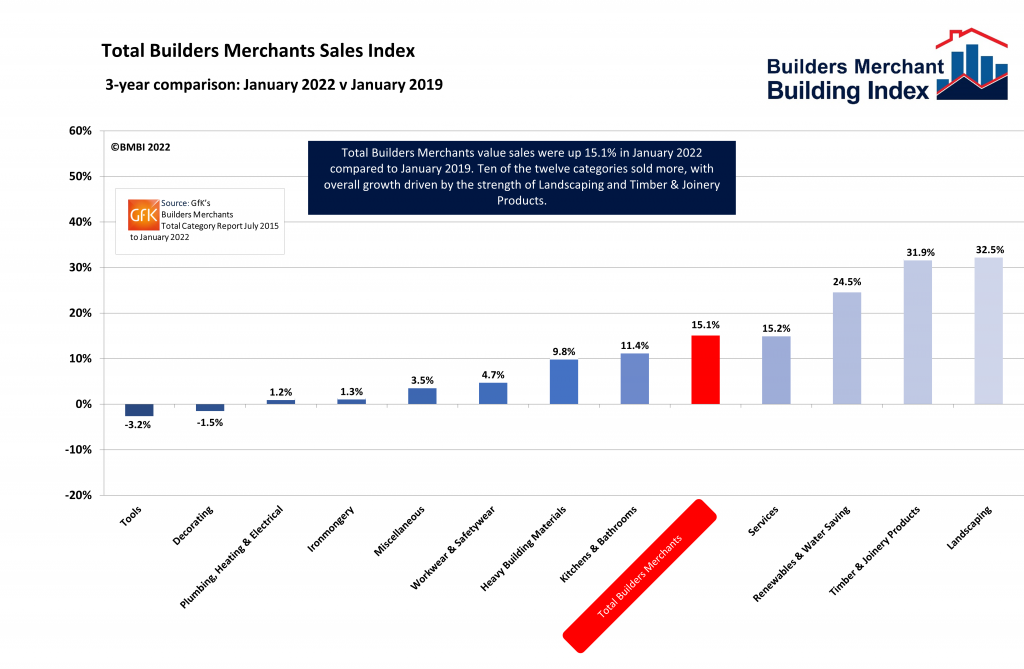

Compared to January 2019, a pre-pandemic year, total merchant value sales were 15.1% higher in January 2022, with two less trading days this year. Over the same period, prices increased at a faster rate (+19.8%), while volume sales were down 3.9%.

Ten of the 12 categories sold more with Landscaping (+32.5%) and Timber & Joinery Products (+31.9%) again leading the charge. Total like-for-like value sales were 26.6% higher than January 2019.

Last three months

Total sales in the three months from November 2021 to January 2022 were up 19.3% on the same period last year, with all categories selling more. Timber & Joinery Products (+29.2%) did best, while Landscaping (+21.2%), Heavy Building Materials (+16.4%) and Plumbing Heating & Electrical (+14.6%) also grew strongly. Total like-for-like sales were 17.3% higher.

Compared to the same three months in 2019/20, sales were 18.8% higher with no difference in trading days. Timber & Joinery Products (+40.2%) and Landscaping (+36.7%) both did particularly well.

Month-on-month

Month-on-month total merchant sales were 28.7% up in January 2022 compared to December 2021, helped by three more trading days in January. In the main categories, Timber & Joinery Products (+32.7%) performed best, followed by Ironmongery (+30.7%), Tools (+30.6%) and Heavy Building Materials (+30.1%). Like-for-like sales were up 9.4%.

Rolling 12-months

Total Merchants sales in February 2021 to January 2022 were 32.8% higher than in the same 12 months a year earlier, with no difference in trading days. All categories sold more but Timber & Joinery Products (+53.9%) was significantly higher than other categories. Landscaping (+32.7%), Tools (+28.8%) and Kitchens & Bathrooms (+28.1%) were next-strongest.

Andrew Simpson, Packed Products Director for Hanson Cement and BMBI’s Expert for Cement & Aggregates, says: “With a robust pipeline of new work being reported, we are already seeing the signs that the strong growth seen in 2021 could be sustained into 2022 and 2023.

“Sales are high, but so too are our costs. Carbon and energy prices are the highest they’ve ever been, and they are still rising. Carbon credits have more than doubled.

Pressures

“To add to industry’s cost pressures, April 2022 will see a ban on the use of red diesel on construction sites, and a new plastic packaging tax. We have already invested in new Tough Bags for our bagged cement products, which are predominantly paper but have a small plastic element, to reduce our plastic use. Demand for plastic packaging with recycled content is increasing, which puts pressure on its supply chain.

“Supply chain issues eased considerably at the end of last year, but beware – the issues are far from resolved, they are just less prevalent. When product demand returns to normal in the Spring, don’t be surprised to see the return of pinch points, such as driver and haulage shortages.

“We are urging merchants to keep stock levels high, so they don’t get caught out later down the line by the same supply chain disruptions we saw throughout 2021.

“If the pandemic has taught us anything, it’s to expect the unexpected and plan for the worst. We are better prepared for 2022 than we were for 2021, and we are now quicker to react and ready for whatever the year has in store.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit bmbi.co.uk

t: 01453 521 621

e: enquiries@bmbi.co.uk

Visit Supplier's page

Latest news

29th April 2025

Senior pledges to ‘bee’ part of the solution with new biodiversity initiative

Senior Architectural Systems has installed its first on-site beehive, marking another step forward in its commitment to sustainability and biodiversity.

Posted in Articles, Building Industry News, Building Products & Structures, Building Services, Curtain Walling, Doors, Glass, Glazing, Innovations & New Products, news, Restoration & Refurbishment, Retrofit & Renovation, Sustainability & Energy Efficiency, Walls, Windows

29th April 2025

West Fraser range delivering key benefits for South-East carpentry company

An experienced carpenter and building site manager who has recently set up his own company is using high performance panel products from the West Fraser range.

Posted in Articles, Building Industry News, Building Products & Structures, Building Systems, Case Studies, Garden, Restoration & Refurbishment, Retrofit & Renovation, Sustainability & Energy Efficiency, Timber Buildings and Timber Products

29th April 2025

CPD Courses Available Online From Ecological Building Systems

Ecological Building Systems, a leading supplier of natural building products for sustainable construction, has revealed its comprehensive CPD programme for the year ahead.

Posted in Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Continuing Professional Development (CPD's), Information Technology, Innovations & New Products, Insulation, Restoration & Refurbishment, Retrofit & Renovation, Seminars, Sustainability & Energy Efficiency, Training, Walls, Waste Management & Recycling

29th April 2025

WindowBASE launches new prospect databases at FIT Show

Visit WindowBASE at the FIT Show to see first-hand how it helps companies find new customers – the company is launching an easy-to-use, intuitive platform on Stand G16 at the NEC Birmingham from 29th April – 1st May.

Posted in Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Doors, Exhibitions and Conferences, Glass, Glazing, Information Technology, Innovations & New Products, Posts, Publications, Research & Materials Testing, Restoration & Refurbishment, Retrofit & Renovation, Windows

Sign up:

Sign up: