6.2 per cent house price increase ‘lower than expected’

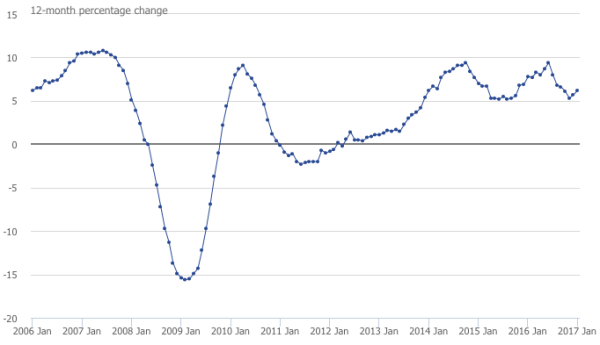

Average UK house prices have grown by 6.2 per cent in the past year up to January 2017, according to the UK House Price Index from the Office of National Statistics. The average price of a property in the UK has grown to £218,255, up £1,000 (0.8 per cent) from December 2016 and £13,000 higher than January 2016.

On a national basis, the biggest contribution towards the increase in UK house prices came from England, which saw a 6.5 per cent increase up to £235,000 on average.

The average property price in Wales increased to £146,000 (4.2 per cent), whilst Scotland saw the average house price rise by 4.0 per cent to stand at £142,000. Properties in Northern Ireland increased by 5.7 per cent over the past year, standing at £125,000.

London remains by far the most expensive region to purchase property, with the average house costing £491,000, followed by the South East (£319,000 avg) and the East of England (£279,000 avg). The East of England also saw the highest annual growth, with prices up 9.4 per cent compared to January 2016.

The North East saw the lowest growth, where prices increased by just 2.2 per cent over the year to £124,000.

Despite the increase across all regions of the UK, the figure still remains below the average annual house price growth seen in 2016 of 7.4 per cent. Garrington Property Finders managing director, Jonathan Hopper, commented on the figures released today: “All three of the UK’s fastest-rising markets have slipped below the double-digit rates of annual price growth they were clocking in 2016.

Such blistering price inflation was always going to be unsustainable, and across the UK prices are now rising at a more halting pace as an uneasy standoff plays out between cautious buyers and sellers who know they have less competition than usual.

While the lack of supply is steadily nudging up average prices, pragmatic vendors are realising that this is anything but a seller’s market. Astute buyers are increasingly able to ask for, and secure, sizeable discounts. Buyer confidence is not unlimited though, and on the front line we’re seeing that househunters, though committed, are highly price-sensitive.

Today’s surge in consumer inflation past the Bank of England’s 2% target will pare back people’s purchasing power and increase the likelihood of an interest rate rise. As a result buyer caution will become an increasingly dominant force in 2017. Further price rises will come, but the progress will be modest.”

Latest news

21st February 2025

ASSA ABLOY EMEIA: Save valuable time and money with a seamless switch to programmable digital keys

In 2025, access management can be a whole lot easier. By making access part of their digital processes, businesses can put time-consuming key management and the cost of changing the locks firmly behind them. Making this switch is a lot easier than many people think, as ASSA ABLOY explains here…

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Information Technology, Innovations & New Products, Retrofit & Renovation, Security and Fire Protection

21st February 2025

Showersave supports industry leaders in addressing Part L and Part G regulations

Showersave has sponsored and participated in a recent Building Insights LIVE roundtable on ‘Water & Energy Saving Innovations in New Build Housing’.

Posted in Articles, Bathrooms & Toilets, Bathrooms, Bedrooms & Washrooms, Building Associations & Institutes, Building Industry Events, Building Industry News, Building Products & Structures, Building Regulations & Accreditations, Building Services, Exhibitions and Conferences, Interiors, Pipes & Fittings, Plumbing, Retrofit & Renovation, Sustainability & Energy Efficiency

21st February 2025

GEZE: The importance of Specifying High Quality Door Closers on Fire Doors

Andy Howland, Sales & Marketing Director at GEZE UK, discusses why specifying high quality door closers on fire doors is important…

Posted in Access Control & Door Entry Systems, Accessibility, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Regulations & Accreditations, Building Services, Doors, Facility Management & Building Services, Health & Safety, Posts, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection

21st February 2025

Insight Data achieves ISO9001 recertification with zero non-conformities

Leading industry data specialist, Insight Data, has successfully achieved the prestigious recertification for ISO9001 with zero non-conformities for the fourth consecutive year.

Posted in Articles, Building Industry News, Building Regulations & Accreditations, Building Services, Information Technology, Research & Materials Testing

Sign up:

Sign up: