GUEST ARTICLE: All the gear and no idea? Wales tops DIY procrastination list

The UK’s leading price comparison website, MoneySuperMarket, has revealed the situations where Brits are more likely to take on a DIY task themselves instead of hiring a professional.

There’s no shortage of DIY procrastination in Britain, with more than half of all regions revealing that they regularly avoid completing DIY tasks. Over 75% of people hire an expert to fix roof damage, a broken boiler or window

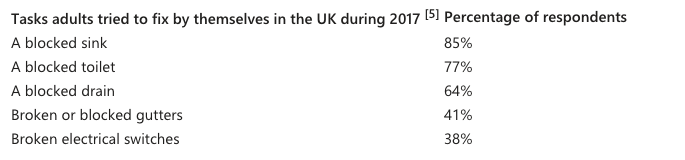

However, there are many issues that Brits tackle themselves, with 69% of them doing so to save money:

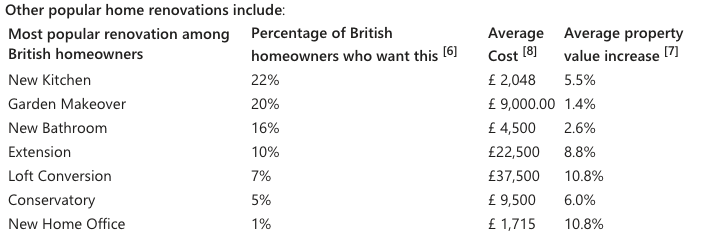

The most popular home renovation among British homeowners is a new kitchen, according to 22% of the population [6], with it potentially adding on average 5.5% to the value of your home when looking to sell.

Alternatively, you can also increase your property value by creating a home office or loft conversion (10.8%)[7]. And if the fear of high costs are a concern, a home improvement loan could be a good way to increase the value of your property and stay within your budget.

Some of the UK’s biggest DIY investors include London, where the average home improvement loan is £16,013, Brighton, where it’s £14,622, and Southampton, with £14,590[2].

Rachel Wait, consumer affairs spokesperson at MoneySuperMarket, commented: “With a fifth of us saying a new kitchen would be our most-desired renovation [6], and a range of different DIY projects potentially adding value to our homes, it’s clear that home renovation offers a real opportunity to live better and invest in your financial future – whether you build it yourself or hire a professional.

“However, it’s always important to make sure any renovations you carry out don’t affect your home insurance policy – or if they do, to ensure that your policy is kept up to date with any changes.

“If you are thinking about home improvements, it’s worth carefully considering how you will pay for them and the benefits they could bring.

“Even those that might not seem affordable could be achieved with smart financial planning, including budgeting, investigating how the price of the property may increase after the renovation, and potentially looking into a home improvement loan – but always ensure you have a plan in place to keep up with the repayments.”

References

1) https://www.statista.com/statistics/809393/diy-avoidance-by-region-united-kingdom-uk/

2) MoneySuperMarket data collected June 2017-July 2019

3) https://www.statista.com/statistics/808617/reasons-for-doing-diy-repairs-vs-hiring-a-professional-united-kingdom-uk/

4) https://www.statista.com/statistics/808591/household-problems-for-which-people-hire-a-professional-united-kingdom-uk/

5) https://www.statista.com/statistics/808574/household-problems-people-fix-themselves-united-kingdom-uk/

6) https://www.idealhome.co.uk/news/most-popular-home-improvement-205277

7) https://www.hiscox.co.uk/sites/uk/files/documents/2018-03/Hiscox_renovations_extensions_report_2018.pdf

https://web.archive.org/web/20171115115524/https://www.movewithus.co.uk/house-estimate/how-are-the-home-improvements-calculated

8) http://www.homeadviceguide.com/a-guide-to-kitchen-installation-costs/ (value has been generated from averages of all relevant figures listed)

https://www.jhps-gardens.co.uk/about-us/pricing/

https://victoriaplum.com/blog/posts/how-much-should-you-pay-to-have-a-bathroom-fitted

https://householdquotes.co.uk/flat-pack-extension/

https://householdquotes.co.uk/what-is-the-average-cost-of-a-conservatory/

Latest news

23rd July 2024

Updated Flood Resilience Brochure – Delta Membranes

Delta Membrane Systems Limited, a leader in the waterproofing industry, has released its latest Flood Resilience Brochure.

Posted in Articles, Building Industry News, Building Products & Structures, Building Services, Damp & Waterproofing, Drainage, Drainage Services, Facility Management & Building Services, Innovations & New Products, Plumbing, Posts, Publications, Restoration & Refurbishment, Retrofit & Renovation

23rd July 2024

Refresh for Automatic Door Suppliers Association Academy

The ADSA Academy – the online learning platform for members of the Automatic Door Suppliers Industry – has undergone a radical revamp with improved levels of functionality and personalisation.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Associations & Institutes, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Continuing Professional Development (CPD's), Doors, Facility Management & Building Services, Information Technology, Innovations & New Products, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection, Seminars, Training

23rd July 2024

New Mitsubishi Electric high temperature heat pump offers even more possibilities

Mitsubishi Electric announces the launch of a new high temperature water-to-water heat pump which reduces the global warming potential (GWP) by 56% over the previous models.

Posted in Articles, Building Industry News, Building Products & Structures, Building Services, Facility Management & Building Services, Heating Systems, Controls and Management, Heating, Ventilation and Air Conditioning - HVAC, Innovations & New Products, Plumbing, Retrofit & Renovation, Sustainability & Energy Efficiency

23rd July 2024

ABLOY PULSE: A revolutionary new kinetic energy key system

Abloy UK announces the launch of ABLOY PULSE, a revolutionary kinetic energy key system.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Information Technology, Innovations & New Products, Posts, Security and Fire Protection

Sign up:

Sign up: