BMBI: October Merchant sales climb 7.5%, but inflation’s still driving growth

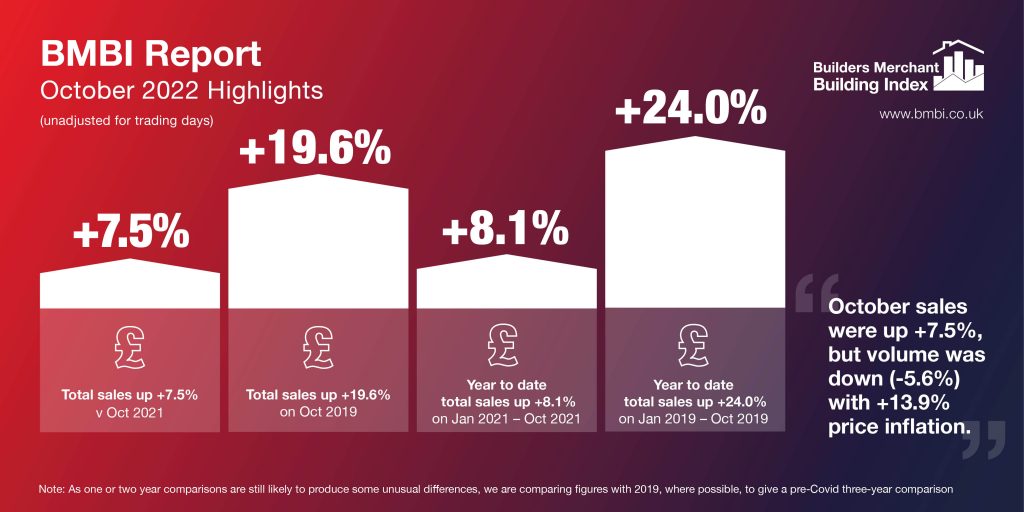

The latest figures from the Builders Merchant Building Index (BMBI), published in December, reveal that builders’ merchants’ value sales were up +7.5% in October 2022, compared to the same month in 2021. Volume sales dropped again (-5.6%) while prices climbed +13.9%, so price inflation was the driving factor of growth.

Eleven of the twelve categories sold more in October compared to the previous year, with eight performing better than Merchants overall. Renewables & Water Saving (+66.1%) was the standout category, while Plumbing, Heating & Electrical (+19.5%), Workwear & Safetywear (+19.0%) and Kitchens & Bathrooms (+17.5%) also had a good month. Timber & Joinery Products (-8.4%) was the only category to sell less.

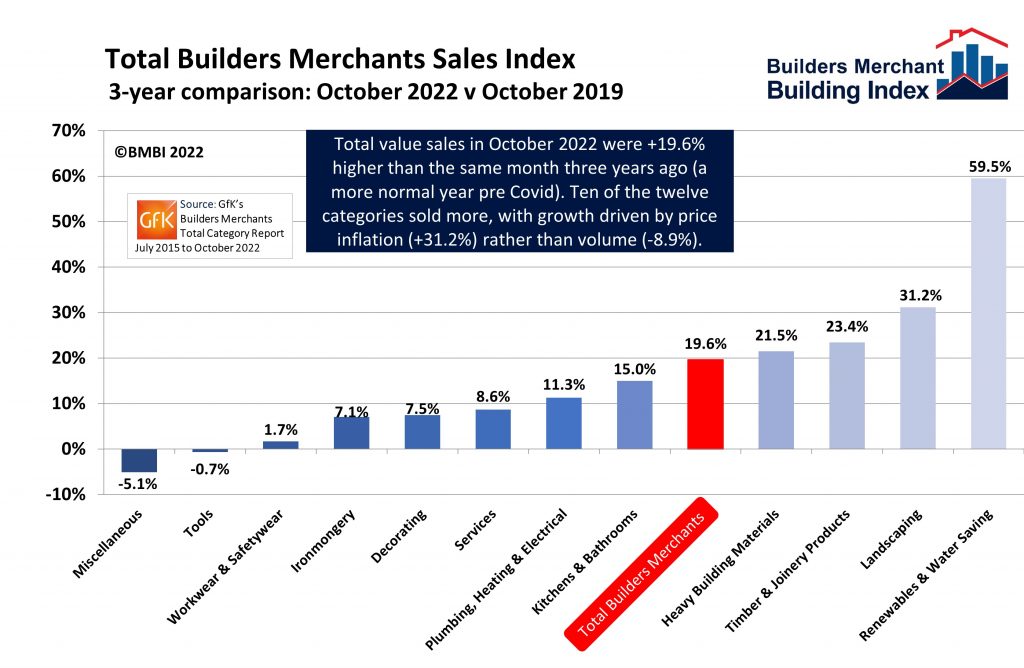

Compared to pre-pandemic October 2019, total merchant value sales were +19.6% higher in 2022. Volume sales fell -8.9% while prices were +31.2% higher. With two less trading days this year, like-for-like sales were up +31.0%. Four of the twelve categories grew more than total Merchants with Renewables & Water Saving (+59.5%) leading the pack. Seasonal category Landscaping (+31.2%), Timber & Joinery Products (+23.4%) and Heavy Building Materials (+21.5%) also fared well.

Year-to-date

Total value sales in the period January to October 2022 were +8.1% higher than January to October 2021. Volume sales were -6.8% lower but prices were up +16.0%. With two less trading days this year, like-for-like sales were +9.1% higher. All bar one category sold more with Renewables & Water Saving (+29.9%) and Kitchens & Bathrooms (+20.1%) the strongest. Plumbing, Heating & Electrical (+14.0%) and Heavy Building Materials (+12.9%) also grew more than Merchants overall. Timber & Joinery Products was flat (-0.2%).

Compared to the same period in 2019, a more normal pre-pandemic year, year-to-date sales were +24.0% higher. This was driven by price inflation (+28.6%) as volumes were down (-3.6%). With four less trading days in the most recent period, like-for-like sales were +26.4% higher. All categories sold more.

Month-on-month

Month-on-month, total merchant sales dropped slightly (-0.9%) in October compared to September. Volume sales were also marginally down (-1.8%) and prices edged up (+0.9%). Plumbing, Heating & Electrical (+9.3%) grew most, followed by Tools (+5.4%). Landscaping (-8.1%) was the weakest.

Rolling 12-months

Total Merchants sales in the 12 months November 2021 to October 2022 were +23.5% higher than in the same 12 months three years earlier (November 2018 to October 2019). With two less trading days in the most recent period, like-for-like sales were up +24.5%.

All categories sold more with Landscaping (+38.1%), Timber & Joinery Products (+36.6%) and Renewables & Water Saving (+31.0%) well out in front. Heavy Building Materials (+20.5%) and Kitchens & Bathrooms (+18.5%) grew more slowly.

Derrick McFarland, Managing Director Keystone Group UK and BMBI’s Expert for Steel Lintels, says: “The third quarter of 2022 was certainly a change from the previous two years with volumes crashing well below 10%. New enquiries were also down well below 10%. Confidence is being squeezed out of the market with ‘mini’ budgets, a series of u-turns, and increased mortgage rates.

‘R-word’

“The dreaded R-word is here too, and the short to mid-term outlook will be challenging. The pound note margin, as opposed to the percentage margin, is critical as the costs of maintaining businesses continues to rise even when our raw material pricing is stabilising.

“But, in spite of the gloom and doom we do have our ‘Key’ areas to focus on. The new Building regulations 2022 will require manufacturers and builders’ merchants to manage stock ranging in greater detail. Wider cavities and thermal performing lintels are becoming more frequently specified.

“At Keystone we have increased our breadth of stock to cover up to 150mm wide cavities along with an extended Hi-therm range to help satisfy the variance in demand coming into 2023. It is envisaged that standard 100mm cavity steel lintel requirements will decrease, hence greater attention to stock management in line with specification will be a priority from now on.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

t: 01453 521 621

e: [email protected]

Visit Supplier's page

Latest news

22nd November 2024

Insight Data: Using Marketing Data to Build a Successful Business in 2025

Alex Tremlett, Insight Data’s Commercial Director, discusses the challenges for construction firms in 2025 and shares six strategies for success…

Posted in Articles, Building Industry News, Building Services, Information Technology, news, Research & Materials Testing

22nd November 2024

Purplex: A tough Budget, but opportunity still knocks

Incoming governments, especially those with significant mandates, inevitably come into power on a tidal wave of optimism coupled with hope that ‘Things can only get better’. Andrew Scott, MD of construction-focused, full-service agency Purplex, talks…

Posted in Articles, Building Industry News, Building Services, Information Technology, news, Posts, Research & Materials Testing

22nd November 2024

Pop Up Power Supplies Gets Arty in Yorkshire

Pop Up Power Supplies has installed 13 new electricity units at The Hepworth Wakefield – read more in this article…

Posted in Articles, Building Industry News, Building Products & Structures, Building Services, Case Studies, Civil Engineering, Facility Management & Building Services, Garden, Hard Landscaping & Walkways, Landscaping, Posts, Restoration & Refurbishment, Retrofit & Renovation

22nd November 2024

OPT Services Revolutionises Fibre Cable Capping with Eco-Friendly Innovation

UK-based OPT Services has unveiled SlimLine™ Capping, a groundbreaking fibre cable protection solution that promises to deliver significant environmental and installation advantages to the fibre optic industry.

Posted in Articles, Building Industry News, Building Products & Structures, Building Services, Facility Management & Building Services, Information Technology, Innovations & New Products, Sustainability & Energy Efficiency

Sign up:

Sign up: