BMBI: Merchant value sales fall again in May

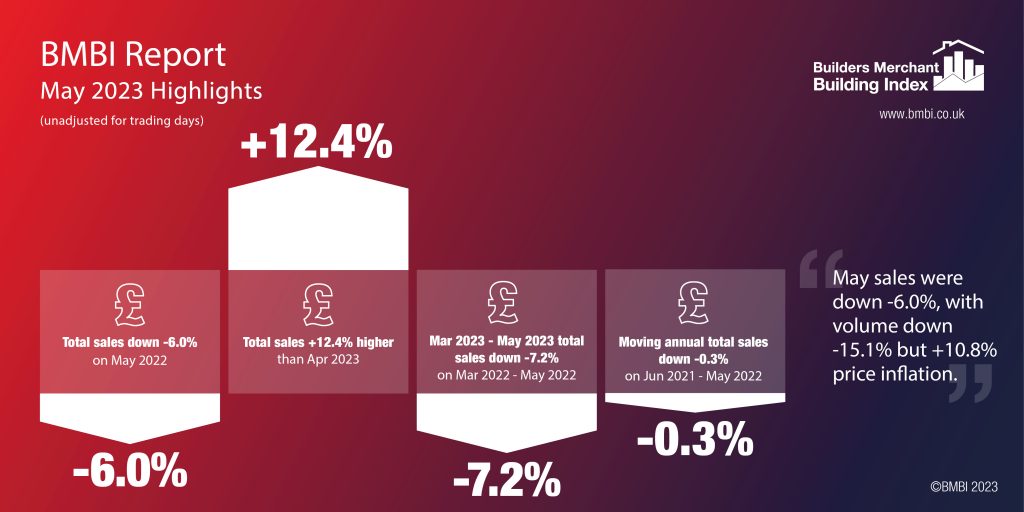

The latest figures from the Builders Merchant Building Index (BMBI), published in July, reveal builders’ merchants’ value sales were down by -6.0% in May, compared to the same month in 2022.

Volume sales fell -15.1% with price inflation of +10.8%. With one less trading day in May 2023, like-for-like sales were -1.3% lower.

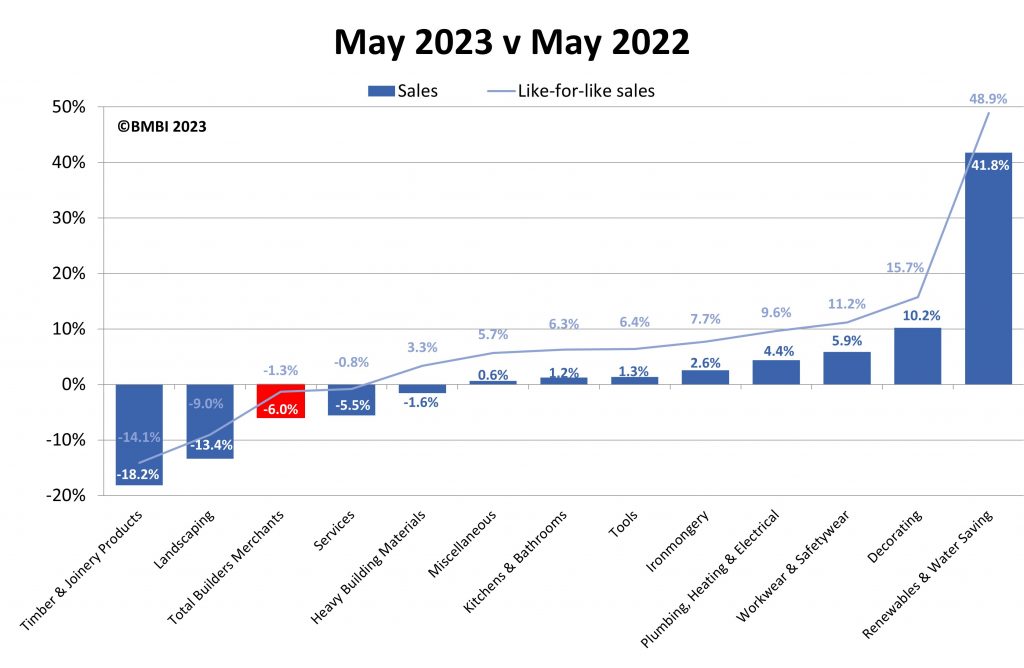

Eight of the twelve categories sold more this year than in May 2022. Renewables & Water Saving (+41.8%) grew the most, followed by Decorating (+10.2%) and Workwear & Safetywear (+5.9%). Heavy Building Materials (-1.6%), Landscaping (-13.4%) and Timber & Joinery Products (-18.2%) were all down year on year.

Month on month

Month-on-month, total merchant sales climbed +12.4% in May compared to April 2023. Volume sales were up +14.1% while prices decreased slightly (-1.5%). With two extra trading days in May, like-for-like value sales were up +1.1%. All categories sold more with Landscaping (+18.6%) and Heavy Building Materials (+13.3%) growing the most. Workwear & Safetywear (+11.3%), Decorating (+10.7%), Timber & Joinery Products (+10.6%) and Ironmongery (+10.3%) also hit double digit growth, while Plumbing, Heating & Electrical (+7.1%) and Tools (+7.2%) grew the least.

Rolling 12-months

Total merchant sales in the twelve months from June 2022 to May 2023 were -0.3% lower than the same period a year ago, with volumes down -13.6% and price inflation of +15.4%. With five less trading days in the most recent period, like-for-like sales were +1.8% higher. Ten of the twelve categories sold more with Renewables & Water Saving (+41.0%) outperforming the other categories by some margin. Workwear & Safetywear (+14.3%),

Plumbing, Heating & Electrical (+12.2%), Decorating (+11.6%) and Kitchens & Bathrooms (+11.0%) also made double figures. Heavy Building Materials (+5.7%) grew more slowly. Landscaping (-10.4%) and Timber & Joinery Products (-13.6%) sold less.

Andrew Simpson, Packed Products Director Hanson Cement and BMBI’s Expert for Cement & Aggregates, says: “Low consumer confidence and higher mortgage rates have affected housebuilders’ expectations, and some of the largest sharply pegged back their forward build programmes, and reduced housebuilding starts which reduced heavy aggregate volumes at the start of the year.

“Inflation impacted the delivery of infrastructure works, with major projects like HS2 being delayed. Wages and material costs continue to cause issues across the board.

“Our challenges don’t stop at cost pressures. Sustainability is our biggest challenge by far. Changes to the extended producer responsibility for packaging rules means more businesses now need to comply, undoubtedly leading to a sharp increase in packaging costs.

‘Efforts are being noticed’

“Cement is an energy intensive manufacturing business, and we have a way to go to decarbonise our operations, but our efforts are being noticed: Hanson recently scooped the Caring for the Environment award from the Worshipful Company of Builders Merchants and we shared our progress and what we’ve learned on our journey at our ‘Let’s Talk Sustainability’ online event earlier this year.

“There is also better news afoot. According to the Mineral Products Association, there was a rebound in sales at the start of the year after the sharp losses seen in the second half of 2022. Primary aggregates sales stabilised (+3.3%), while asphalt (+1.8%) returned to quarter-on-quarter growth after three consecutive declines. Ready-mixed concrete sales grew (+9.8%) and mortar (+6.0%) sales also picked up after a poor end to 2022.

“The Office of Budget Responsibility (OBR) remains upbeat about the outlook for the UK, predicting growth from the second half of 2023. The general feeling in the industry is one of optimism, as better weather ushers in a boost in sales and the ‘green shoots’ of change.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

t: 01453 521 621

e: enquiries@bmbi.co.uk

Visit Supplier's page

Latest news

28th March 2025

Ideal Heating Commercial announces 10-year warranty on Evomax 2 boiler

Evomax 2, the UK’s number one selling commercial wall-mounted boiler from Ideal Heating Commercial, is now available with a 10-year warranty.

Posted in Articles, Building Industry News, Building Products & Structures, Building Regulations & Accreditations, Building Services, Facility Management & Building Services, Heating Systems, Controls and Management, Heating, Ventilation and Air Conditioning - HVAC, Innovations & New Products, Pipes, Pipes & Fittings, Plumbing, Retrofit & Renovation, Sustainability & Energy Efficiency, Videos

28th March 2025

FLIR Si1-LD Acoustic Imaging Camera for Compressed Air Leak Detection

FLIR, a Teledyne Technologies company, introduces the Si1-LD, an industrial acoustic imaging camera that brings faster and more accurate compressed air leak detection to those operating on a modest condition monitoring budget.

Posted in Acoustics, Noise & Vibration Control, Articles, Building Industry News, Building Products & Structures, Building Services, Facility Management & Building Services, Information Technology, Innovations & New Products, Retrofit & Renovation, Sustainability & Energy Efficiency, Thermal Imaging and Monitors

28th March 2025

LIFTEX 2025 Seminar programme announced

Registration has opened for LIFTEX 2025. Now in its 37th year, LIFTEX 2025 is the UK’s only dedicated exhibition for the lift, escalator and access industry and takes place only once every three years.

Posted in Access Control & Door Entry Systems, Accessibility, Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Regulations & Accreditations, Building Services, Exhibitions and Conferences, Facility Management & Building Services, Health & Safety, Retrofit & Renovation, Security and Fire Protection, Seminars

28th March 2025

MCRMA welcomes ArcelorMittal UK to membership

A UK division of the global steelmaking business ArcelorMittal has become the latest new member of the MCRMA, the industry association representing the metal building envelope sector.

Posted in Articles, Building Associations & Institutes, Building Industry News, Building Products & Structures, Building Systems, Cladding, Facades, Posts, Restoration & Refurbishment, Retrofit & Renovation, Roofs, Steel and Structural Frames, Walls

Sign up:

Sign up: