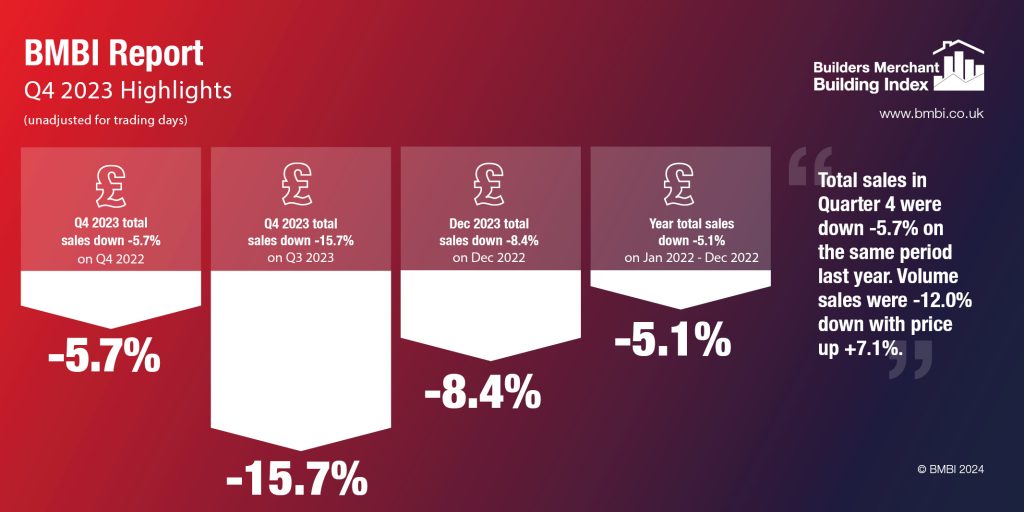

The latest total value sales figures from Builders Merchant Building Index (BMBI) show that Q4 2023 sales were -5.7% down compared to Q4 2022, with volumes falling -12.0% and prices rising +7.1%. With one more trading day in Q4 2023, like-for-like sales (which take the number of trading days into account) were -7.3% down.

Year-on-year, half of the twelve categories sold more in Q4, including Workwear & Safetywear (+8.6%) and Decorating (+7.1%). However, the three largest categories all sold less: Landscaping (-6.7%), Heavy Building Materials (-7.3%) and Timber & Joinery Products (-10.3%).

Quarter-on-quarter

Total value sales for Q4 were down -15.7% compared to Q3. Volume sales fell-19.8% while prices rose +5.1%. With four less trading days in the most recent period, like-for-like sales were -10.1% lower. Workwear & Safetywear (+17.0%) and Plumbing, Heating & Electrical (+4.4%) were the only two categories to sell more.

December sales, Year-on-Year

Total Builders Merchants value sales for the month were -8.4% lower than December 2022. Volume sales were -12.6% down, and prices were up +4.8%. Just four of the twelve categories sold more year-on-year, including Workwear & Safetywear (+4.8%), Decorating (+4.1%) and Ironmongery (+0.4%). The four largest categories all sold less: Landscaping (-6.2%), Plumbing Heating & Electrical (-6.4%), Timber & Joinery Products (-10.4%) and Heavy Building Materials (-11.0%).

December sales, Month-on-Month

December value sales were -37.5% behind November. But with six less trading days in December, like-for-like sales were -14.1% lower. Month-on-month, volume sales were down -39.8% with prices edging up +3.8%. All categories sold less.

Last 12 months

January to December 2023 value sales were down -5.1% on the same 12-month period in 2022. With two extra trading days in 2023, like-for-like sales were -5.9% down. Overall, volume sales plunged -13.7% for the year, while prices increased +10.0%.

Paul Edworthy, Commercial Lead: Builders Merchant Group, Dulux Trade and BMBI’s Expert for Paint, says: “At the end of 2023 the trade paint market stood at 1.5% growth year-on-year, after mostly flat Q4 volume sales.

“In contrast, the trade woodcare market attained growth of 9% year-on-year, with data suggesting much of this growth was driven by Builders’ Merchants. Against a gloomy economic outlook, growth of these markets provides assurance of the continued value of builders’ merchants to wider society.”

Awaab’s Law

Paul continues: “The effects of a high Bank Rate muted housing market activity, resulting in fewer housing transactions, especially for newly built properties. While this has led to reports of less paint being used in the new housing sector, recovery has been good for volume used in the existing housing market.

“Volume growth is strongest for private dwellings, and green shoots of growth continued in Q4 within existing social housing repair and maintenance, both possibly driven by the Government’s commitment to delivering ‘Awaab’s Law’ in an amendment to the Social Housing Regulation Bill.

“Known as Awaab’s Law, it sets deadlines for social landlords in England and Wales to tackle reported hazards promptly. Two-year-old Awaab was killed by mould in a social housing flat in Rochdale in 2020. Significantly, Labour leader Sir Keir Starmer confirmed in February that Labour intends to extend Awaab’s Law into the private rental sector.

“Sales to builders’ merchants finished -2.3% down year-to-date on last year, indicating that there is potential for greater growth in the channel, as it currently lags the performance of the total market.

“Reports of workloads from professional decorators remain elevated for the time being, adding to our expectations that the trade paint market will be robust through 2024 in terms of volumes.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.