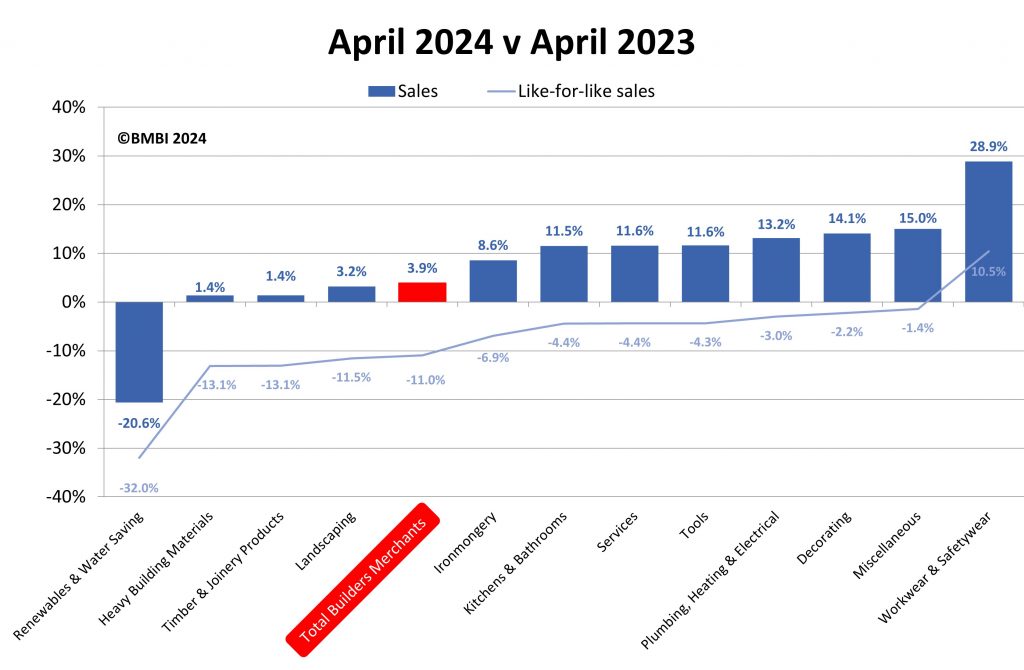

The latest Builders Merchant Building Index (BMBI) report shows builders’ merchants’ value sales were up +3.9% in April, in comparison to the same month a year ago. Volume sales increased +4.7% and prices eased -0.8%. However, with three additional trading days this year, like-for-like value sales were down -11.0%.

Year-on-Year

Compared to April 2023, eight of the twelve categories outperformed Total Merchants, with Workwear & Safetywear (+28.9%), Miscellaneous (+15.0%), Decorating (+14.1%) and Plumbing, Heating & Electrical (+13.2%) leading. But the three largest categories – Heavy Building Materials (+1.4%), Timber & Joinery Products (+1.4%) and Landscaping (+3.2%) – all grew more slowly.

Month-on-Month

April total value sales were +5.0% higher than the previous month. Volume sales increased +7.4% and prices were down -2.3% in comparison to March. With one more trading day in April, like-for-like value sales were flat (+0.0%). Ten of the twelve categories sold more, with seasonal category Landscaping (+15.4%) well up. But Heavy Building Materials (+4.8%) and Timber & Joinery Products (+3.6%) recorded more moderate growth. Plumbing Heating & Electrical (-1.4%) and Workwear & Safetywear (-4.6%) were the weakest performing categories.

Rolling 12 months

Total merchant sales in the 12 months from May 2023 to April 2024 were -4.7% lower than the same period the year before (May 2022 to April 2023). Volume sales slumped -9.6% and prices rose +5.4%. With four extra trading days in the most recent 12-month period, like-for-like sales were down -6.3%. Nine categories sold more with Workwear & Safetywear (+8.3%), Decorating (+7.5%) and Miscellaneous (+5.3%) the strongest performers. The three largest categories – Heavy Building Materials (-5.0%), Landscaping (-5.7%) and Timber & Joinery Products (-11.3%) – all sold less.

Chris Fisher, Vice President of the EMEA (LBMH) division of ECI Software Solutions and BMBI’s Expert for Website and Product Data Management Solutions, says: “Now we’re well into 2024, we are seeing what was predicted: timber prices continue to suffer, workforce challenges remain, and nationals swallowing up merchants and implementing even more modern solutions that make customer experience (for merchants and consumers) more convenient than ever. This means smaller merchants are tightening their finances, while remaining focused on customer loyalty.

“Retail businesses have always been ahead of the curve in online shopping for consumers, but now they are investing in ecommerce for trade customers that goes beyond online shopping. Ecommerce systems integrated with your business operations systems, such as your ERP, are designed for more than ‘adding to basket’ and ‘click & collect’ functionalities.

“These connected systems allow tradespeople to organise their customers’ projects, lookup quotes and materials’ prices, and save orders for recurring projects. Merchants can offer loyalty programs and alerts on inventory changes to help customers keep tabs on their own stock needs.

The solution

“The solution remains: merchants must invest in connected, modern technology to please their customers, and be efficient in their business operations.

“Parts of the industry are moving faster than others in adopting modern technology. Reasons I hear to delay are fear of the unknown, the investment required, and hesitancy to address operational changes that support the shift. I understand the dilemma of not having enough time to implement new technology when business is thriving, and being hesitant to invest when the market slows.

“But merchants should note that customer expectations mean digital servicing is no longer a nice-to-have, or just about online shopping. It’s about a fully integrated system that includes a mobile storefront (ecommerce), in-branch experience (EPOS system), and accounting, business operations and stock management (ERP).”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.