BMBI: August merchant sales are up, but volume is down and inflation’s still climbing

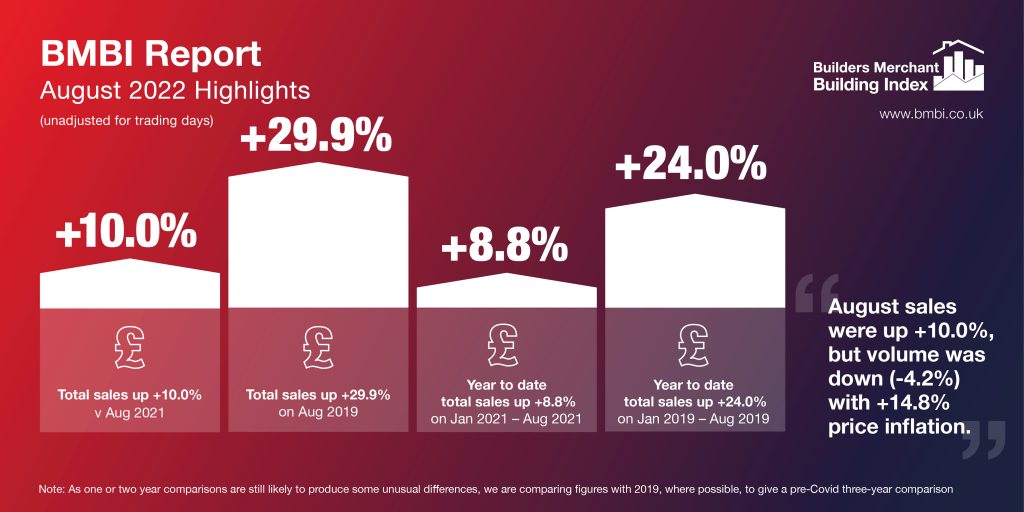

The latest figures from the Builders Merchant Building Index (BMBI), published in October, reveal that builders’ merchants’ value sales were +10.0% up in August 2022 compared to the same month in 2021. But volume sales were down -4.2% with +14.8% price inflation driving growth.

All bar one category sold more in August 2022 compared to the previous year. Nine categories outperformed Merchants overall with Renewables & Water Saving (+27.3%) and Kitchens & Bathrooms (+26.9%) leading the field. Heavy Building Materials (+17.7%) also performed well, while Timber & Joinery Products (-5.7%) sold less. With an extra trading day in August 2022, like-for-like sales were +5.0% higher.

Compared to August 2019, a more normal pre-pandemic year, total merchant value sales were +29.9% higher. Volume sales were down -1.2% while prices were up +31.5%.

With one extra trading day this year, like-for-like sales were up +24.0%. Three of the twelve categories grew more than total Merchants with Timber & Joinery Products (+39.9%) the strongest. Landscaping (+35.8%) and Kitchens & Bathrooms (+30.5%) also fared better.

Heavy Building Materials (+29.6%) grew marginally more slowly, ahead of Plumbing, Heating & Electrical (+18.2%) and other categories.

Year-to-date

Total value sales in the period January to August 2022 were +8.8% higher than January to August 2021. Volume sales were -6.4% lower but prices were up +16.2%. With one less trading day this year, like-for-like sales were +9.4% higher. All categories sold more. Kitchens & Bathrooms (+21.5%) and Renewables & Water Saving (+21.5%) were strongest, while Plumbing, Heating & Electrical (+13.4%) and Heavy Building Materials (+12.8%) outperformed Merchants overall. Timber & Joinery Products (+2.6%) and Landscaping (+1.0%) were weakest.

Compared to the same period in 2019, a more normal pre-pandemic year, year-to-date sales were +24.0% higher, but price inflation was +27.3%, and volume was down -2.6%. With two less trading days in the most recent period like-for-like sales were +25.5% higher. All categories sold more.

Month-on-month

Month-on-month, total merchant sales were up +1.1% in August compared to July. Volume sales were virtually flat (-0.2%) and prices increased +1.3%. With one more trading day in the most recent period, like-for-like sales were down -3.5%. Services (+5.9%) grew the most, with Kitchens & Bathrooms (+4.9%) not far behind. As in July, Landscaping (-6.1%) was the weakest category.

Rolling 12-months

Total Merchants sales in the 12 months September 2021 to August 2022 were +21.9% higher than in the same 12 months three years earlier (September 2018 to August 2019) with no difference in trading days. All categories sold more with Timber & Joinery Products (+39.0%) and Landscaping (+37.3%) well out in front. Renewables & Water Saving (+21.1%), Heavy Building Materials (+17.1%) and Kitchens & Bathrooms (+16.5%) recorded comparatively lower growth and Tools (+0.4%) was weakest.

Andrew Simpson, Packed Products Director at Hanson Cement and BMBI’s Expert for Cement & Aggregates (pictured below), says: “As expected, now COVID travel restrictions have been lifted there has been a shift in consumer behaviour with people keen to get away on holiday, rather than commit to RMI projects over the summer.

“How much of the RMI drop is due to people delaying or rethinking projects due to cost inflation remains to be seen. Underlying data suggests that normal, seasonal sales variances are as they were pre-COVID.

“We expect to see a sales bounce back in Q3 and Q4 as people return from holiday and continue to do home improvement projects. We predict that the repair, maintenance and improvement (RMI) market will stabilise and, if interest rates continue going up, those with savings may choose to spend on home improvements.

“Cost is a big issue for the industry. Russia’s response to the sanctions from the West has had an off-the-scale impact for high energy users. Coal, gas and oil prices are going up and what was £200 p/MWhr is forecast to be over £500 come December.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

t: 01453 521 621

e: enquiries@bmbi.co.uk

Visit Supplier's page

Latest news

30th April 2025

Digital Construction Week announces seminar programme for its landmark 10th edition

Digital Construction Week (DCW) returns to ExCeL London on 4 – 5 June 2025 with its most impactful programme yet. It brings together the best and brightest from across AECO, for two days of practical learning and idea sharing.

Posted in Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Building Systems, Exhibitions and Conferences, Information Technology, news, Restoration & Refurbishment, Retrofit & Renovation, Seminars

29th April 2025

Senior pledges to ‘bee’ part of the solution with new biodiversity initiative

Senior Architectural Systems has installed its first on-site beehive, marking another step forward in its commitment to sustainability and biodiversity.

Posted in Articles, Building Industry News, Building Products & Structures, Building Services, Curtain Walling, Doors, Glass, Glazing, Innovations & New Products, news, Restoration & Refurbishment, Retrofit & Renovation, Sustainability & Energy Efficiency, Walls, Windows

29th April 2025

West Fraser range delivering key benefits for South-East carpentry company

An experienced carpenter and building site manager who has recently set up his own company is using high performance panel products from the West Fraser range.

Posted in Articles, Building Industry News, Building Products & Structures, Building Systems, Case Studies, Garden, Restoration & Refurbishment, Retrofit & Renovation, Sustainability & Energy Efficiency, Timber Buildings and Timber Products

29th April 2025

CPD Courses Available Online From Ecological Building Systems

Ecological Building Systems, a leading supplier of natural building products for sustainable construction, has revealed its comprehensive CPD programme for the year ahead.

Posted in Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Continuing Professional Development (CPD's), Information Technology, Innovations & New Products, Insulation, Restoration & Refurbishment, Retrofit & Renovation, Seminars, Sustainability & Energy Efficiency, Training, Walls, Waste Management & Recycling

Sign up:

Sign up: