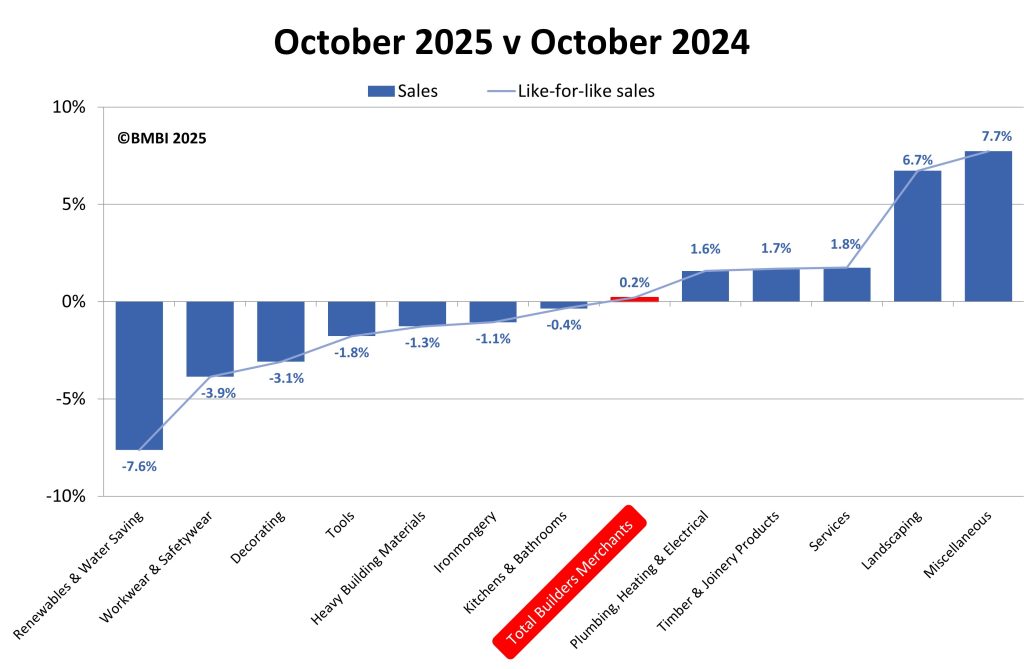

The latest Builders Merchant Building Index (BMBI) report shows builders’ merchants’ value sales in October 2025 were up +0.2% compared to the same month a year before. Year-on-year volumes were up +0.8% but prices were down -0.6%. There was no difference in trading days.

Year-on-Year

Five of the twelve categories sold more in terms of value compared to October 2024, led by Miscellaneous (+7.7%) and Landscaping (+6.7%). Of the two largest categories, Timber & Joinery Products was up +1.7%, but Heavy Building Materials was down -1.3%. Renewables & Water Saving was the weakest performing category (-7.6%).

Month-on-Month

Compared to September, October’s like-for-like value sales (which take trading day differences into account) were down -1.7%. Without the trading day adjustment, total value sales were +2.8% higher month-on-month, with total volumes up +1.7%, and prices up +1.0%.

Looking at month-on-month value sales, ten categories sold more with Workwear & Safetywear (+8.3%), Plumbing, Heating & Electrical (+8.2%), Miscellaneous (+7.9%) and Renewables & Water Saving (+7.0%) doing best. The largest category, Heavy Building Materials (+3.3%) performed better than Total Builders Merchants, while the second largest, Timber & Joinery Products (+2.5%) fell marginally behind.

Latest 12 months

Like-for-like value sales in the 12 months from November 2024 – October 2025 were up +1.1% compared to the previous 12-month period (November 2023 – October 2024). Without the adjustment for the additional trading day in the most recent 12 months, total value sales were +0.7% higher, with total volumes increasing +2.5% and prices falling -1.8%. By value, nine categories sold more with Landscaping (+3.8%), Services (+3.0%) and Miscellaneous (+3.0%) ahead the most. Decorating was weakest (-3.1%).

With an adjustment for one less trading day in 2025, like-for-like value sales for the year-to-date (January to October 2025) were +1.6% higher compared to the first ten months of 2024. Without the adjustment, total builders merchant value sales increased +1.1%.

Chris Dawson, Sales Director at Brett Martin, and BMBI’s Expert for Plumbing & Drainage, comments:

“We hadn’t even learned what horrors the Chancellor’s Budget would contain when the CPA (Construction Products Association) launched its dollop of pessimism into the market with its Autumn Forecasts, downgrading its previous projections for construction in 2026.

“The reality of the third quarter failing to provide the usual Autumn lift has finally knocked the wind out of any aspirations for 2025 to recover the sort of growth that most of us had hoped we would see.

“This time last year, like others in the industry, we were setting our sales budgets with reasonable expectation that by now the markets would be on a steady positive trend line.

“Certainly, for those producers in the heavy side category there is little comfort when viewing like for like sales volumes in the third quarter. Be it RMI or new build, the consumer needs confidence to borrow and spend. This is simply not happening at the levels required to kick start the market back to growth.

“The economy is beyond our control but, as a private business, we plan for the future in the knowledge that this has been a successful strategy throughout our 70 odd years in the industry.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.