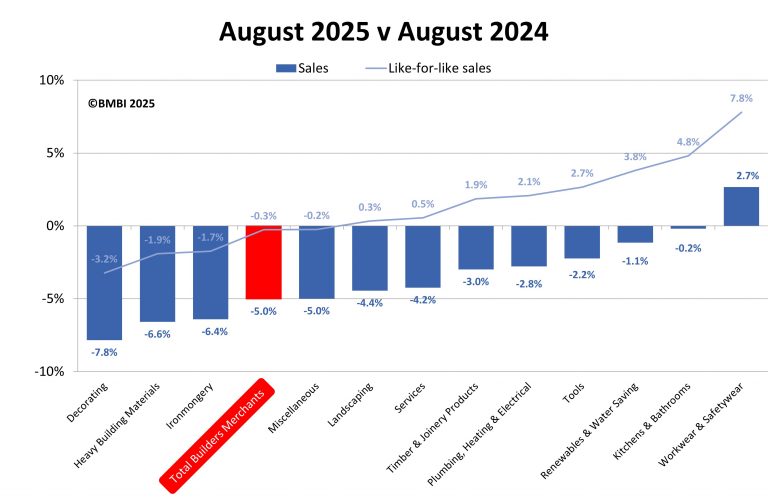

The latest Builders Merchant Building Index (BMBI) report shows builders’ merchants’ value sales in August 2025 were down -5.0% in comparison to the same month a year before. Year-on-year volume decreased -4.1% while prices were down -1.0%. With one less trading day in 2025, like-for-like value sales for August (which take trading days into account) were -0.3% lower.

Year-on-Year

Only one of the twelve categories sold more by value compared to August 2024 – Workwear & Safetywear – which was up +2.7%. The worst performing categories were Ironmongery (-6.4%), Heavy Building Materials (-6.6%) and Decorating (-7.8%), but Timber & Joinery Products (-3.0%) performed better than Total Builders Merchants.

Month-on-Month

Total value sales in August were -12.7% lower than in July. Volume sales were down -13.4% and prices increased +0.8%. All categories sold less, but Ironmongery (-14.5%) and Miscellaneous (-15.0%) declined the most. Heavy Building Materials decreased -13.3%. With three less trading days in August, like-for-like value sales were +0.3% higher.

Latest 12 months

Total value sales in the 12 months from September 2024 – August 2025 were up just +0.1% compared to the previous 12-month period (September 2023 – August 2024). Volume sales were up (+1.9%) but prices decreased (-1.8%). Five categories sold more by value, with Services (+3.1%), Tools (+2.9%) and Landscaping (+2.3%) performing best. Of the two largest categories Timber & Joinery Products fell -0.6% and Heavy Building Materials was flat (0.0%). Decorating (-2.7%) was the weakest category. With one less trading day in the most recent period, like-for-like value sales increased +0.5%.

Total value sales year-to-date (January to August 2025) were up +0.8% compared to the first eight months of 2024.

Andrew Simpson, Packed Products Director at Heidelberg Materials and BMBI’s Expert for Cement & Aggregates, comments:

“After a better-than-expected start to the year, the robust sales seen in Q1 did not continue into Q2, and ready-mixed concrete volumes sank to a historic low. Aggregate sales were lower than expected across the board, and from speaking to our merchant customers, confidence in the market is understandably taking a real hit.

“Most predictions for 2025 were betting on a H2 recovery but the current aggregate sales tell a different story. Less concrete sales in H1, mean fewer concrete slabs to build on in H2, suggesting the foundations have not been laid for recovery in the second half.

‘Hits keep coming’

“And the hits keep coming. The Extended Producer Responsibility (EPR) regulations, which require manufacturers to be responsible for the cost of recycling or disposing of their product’s waste packaging, is in force. The legislation is vague, but we risk fines and prosecution for non-compliance, so we’re asking government for more clarity, particularly on how they define waste categories (household incurs PRN – Producers Recovery Note – and EPR fees, commercial is PRN only).

“Building manufacturers are not shying away from their responsibilities, and where we can, we are moving away from plastic packaging, but this stealth tax on construction is going to impact us all. We need to voice our concerns collectively to ensure the rules are fit for purpose. Merchants can be part of the solution by providing customer data which indicates whether product packaging is likely to end up in household (DIY customers) or commercial (trade) waste.

“The EPR and PRN fees will drive up the price of building products, as we can’t afford to absorb the extra cost, particularly as there’s more rules on the way with the RAM (Recycling Assessment Methodology) framework coming next year.

“For all its rhetoric about generating growth in and through the construction industry, real tangible government support for our sector is yet to materialise and it’s hard to see things improving before the end of the year.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.