BMBI: Bumper Q1 value sales but increase driven more by price inflation than volume

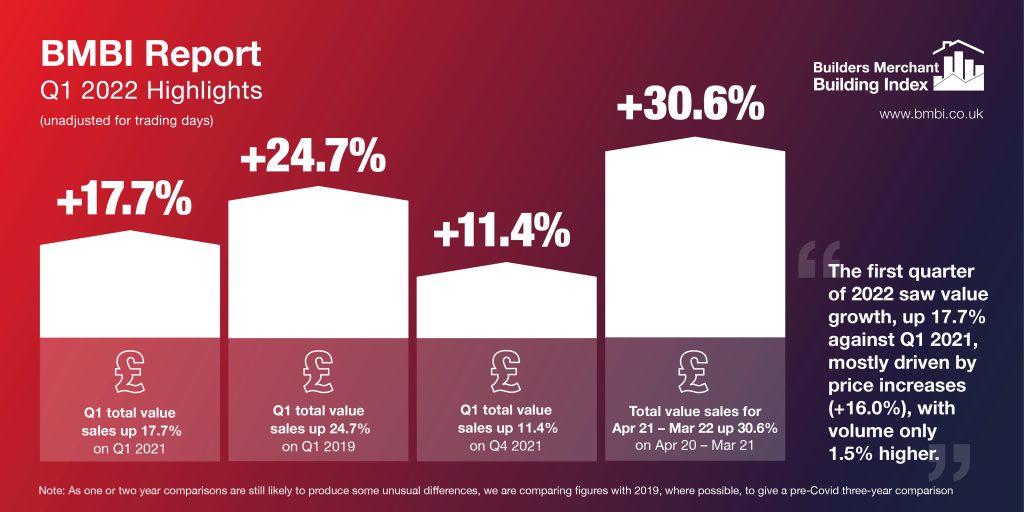

The latest total value sales data from Britain’s Builders’ Merchants shows Q1 2022 was a bumper quarter. This is thanks, in part, to a record-breaking March, which clocked up the highest ever total sales in the history of the BMBI. However this was driven once again by price inflation more than volume growth.

Quarterly sales, Year-on-Year

Quarter 1 2022 total value sales were 17.7% higher than Q1 2021, with no difference in trading days. The was driven by price inflation (+16.0%) more than volume growth (+1.5%). All bar one categories sold more. Renewables & Water Saving (+29.3%) did best, followed by Kitchens & Bathrooms (+26.3%) which also recorded its best-ever quarterly sales. Timber & Joinery Products (+21.4%) and Heavy Building Materials (+17.4% in value) grew more slowly while its volume is up by 5.0%. Plumbing, Heating & Electrical (+16.4%) and Miscellaneous (+12.8%) both had their best-ever quarterly sales. Workwear & Safetywear (-0.1%) was flat.

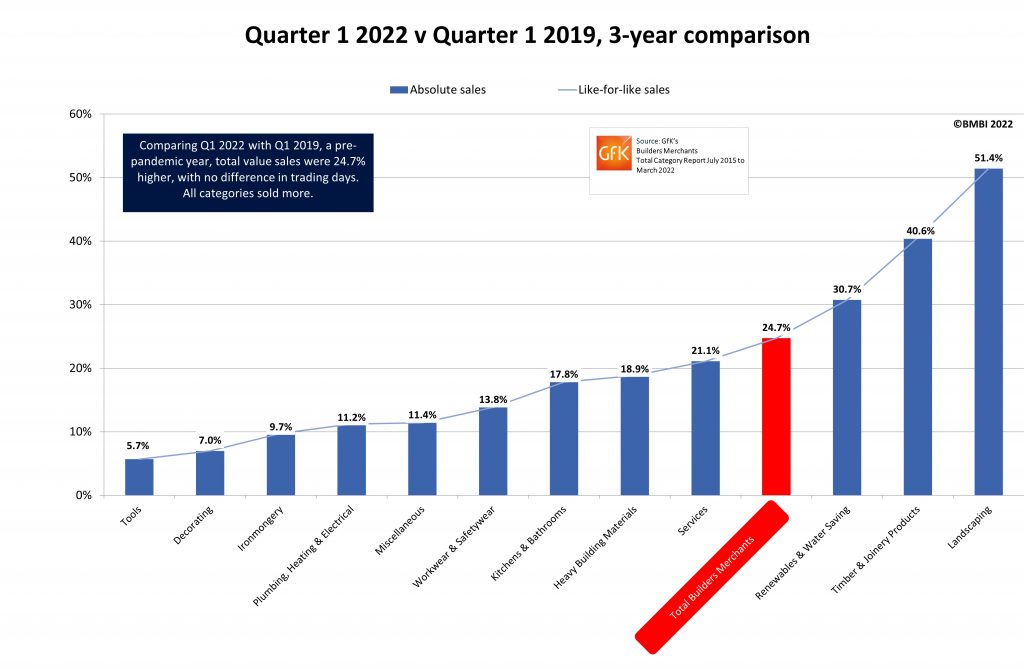

Comparing Q1 2022 with Q1 2019, a pre-pandemic year, total value sales were 24.7% higher, with no difference in trading days. All categories sold more including Landscaping (+51.4%) and Timber & Joinery Products (+40.6%), which did particularly well. Heavy Building Materials (+18.9%), Kitchens & Bathrooms (+17.8%) and Plumbing, Heating & Electrical (+11.2%) all grew more slowly.

Quarter-on-quarter

Quarter-on-quarter, sales were up 11.4% in Q1 2022 compared to Q4 2021, helped by three more trading days in the most recent period. All categories sold more. Renewables & Water Saving (+28.1%), Landscaping (+26.2%), Tools (+13.3%), Plumbing, Heating & Electrical (+12.5%) and Heavy Building Materials (+11.9%) all grew faster than Merchants overall. Like-for-like sales were 6.1% higher than Q4 2021.

March sales, Year-on-Year

Compared to March 2021, when large parts of the country were again under COVID restrictions, total sales were 9.8% higher in March 2022 with no difference in trading days. This was driven entirely by price inflation (+18.5%) rather than volume (-7.3%).

Eleven of the twelve categories sold more with Kitchens & Bathrooms (+25.2%), Plumbing, Heating and Electrical (+16.3%), Heavy Building Materials (+10.5%), Decorating (+7.8%), Ironmongery (+5.9%) and Tools (+2.8%) all having their best-ever month since the BMBI started in July 2014. Only Landscaping (-1.1%) sold less.

Total value sales in March 2022 were 35.0% higher than the same month three years ago. This was helped by two more trading days this year. All categories sold more, with Landscaping (+64.1%) and Timber & Joinery Products (+50.7%) performing the best. Like-for-like sales were 23.3% up.

March sales, Month-on-Month

Total merchant sales in March were 24.1% higher than February, boosted by three extra trading days. Seasonal category Landscaping (+47.2%) outperformed the other categories, while Heavy Building Materials grew by (+24.5%). Workwear & Safetywear (+9.7%) had the slowest growth. Like-for-like sales were 7.9% higher.

Last 12 months

Sales in the 12 months from April 2021 to March 2022 were 30.6% higher than in the same 12 months a year earlier, with one less trading day this year. All categories sold more. Timber & Joinery Products (+47.9%), Renewables & Water Saving (+34.4%) and Kitchens & Bathrooms (32.1%) were the best performing categories.

Gordon Parnell, Sales Director at British Gypsum and BMBI’s Expert for Drylining Systems, says: “The first quarter saw demand off to a slightly slower start than forecasted, with stocks remaining high across the supply chain following year end purchasing.

Gordon Parnell, Sales Director at British Gypsum and BMBI’s Expert for Drylining Systems, says: “The first quarter saw demand off to a slightly slower start than forecasted, with stocks remaining high across the supply chain following year end purchasing.

“However, as we moved through February and into March, purchase levels returned to forecasted volumes. The big question is whether this strong start to the year can be sustained, as the rising cost of inflation puts pressure on supply and demand.

“Released on 21st April, the co-chairs of the Construction Leadership Council’s (CLC) Product Availability Working Group made a joint statement updating the industry on the availability of construction materials and products. While overall product availability remains good, one of the main challenges that we continue to face is the rate at which energy and other costs are rising.

“Last year, there were significant cost increases in raw materials and logistics. Now, like the rest of the sector, our costs are being impacted by the ongoing and rapid rise in energy inflation. Energy is a considerable portion of the cost to make our products and, with energy inflation continuing to soar, it is crucial that we work closely with our construction partner customers to ensure we remain resilient.

Q2

“Looking ahead to Q2 and the rest of 2022, we will continue to seek to mitigate and absorb operating costs where possible and keep our pricing under review for the rest of this year in the face of this unprecedented volatility affecting all customers and the wider UK market.

“Crucially, we will keep our valued partners continually updated, understanding that even the smallest cost increases have a ripple effect along the whole supply chain.

“While we needed to announce incremental price increases this year, we are dedicated to keeping our prices competitive for the long term. One of the ways we are doing this is by future-proofing our distribution network with a focus on delivering for our distribution partners in an efficient, secure, safe and sustainable way.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk

t: 01453 521 621

e: [email protected]

Visit Supplier's page

Latest news

25th March 2025

Reduce sound transference with West Fraser CaberAcoustic

CaberAcoustic from West Fraser is a highly versatile, effective and economical sound-reducing flooring solution. Reducing both impact and airborne transmitted sounds, it can be laid over concrete and timber floors in both new and existing buildings.

Posted in Acoustics, Noise & Vibration Control, Articles, Building Industry News, Building Products & Structures, Building Services, Building Systems, Facility Management & Building Services, Floors, Interior Design & Construction, Interiors, Posts, Restoration & Refurbishment, Retrofit & Renovation, Timber Buildings and Timber Products

25th March 2025

Vent-Axia Kicks Off Charity Football Tournament in Support of Cancer Research UK

Ventilation leader Vent-Axia brought together leading building design professionals for an action-packed Charity Powerleague 5-a-side Football Tournament on Thursday 20th March in Shoreditch, London, in aid of Cancer Research UK.

Posted in Air Conditioning, Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Charity work, Facility Management & Building Services, Heating, Ventilation and Air Conditioning - HVAC

25th March 2025

Jane Elvins bolsters GEZE UK Specification team

GEZE UK, a leading manufacturer and provider of door, window and access control systems, is delighted to welcome Jane Elvins, who joins as Specification and Business Development Manager.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Recruitment, Retrofit & Renovation, Security and Fire Protection, Windows

24th March 2025

Putting Glidevale Protect in the frame at InverTay Homes development

Leading building products manufacturer Glidevale Protect is supplying its construction and roofing membranes for a new timber frame housing development currently being constructed by InverTay Homes in Dundee.

Posted in Articles, Building Industry News, Building Products & Structures, Building Services, Building Systems, Case Studies, Facility Management & Building Services, Membranes, Restoration & Refurbishment, Retrofit & Renovation, Roofs, Sustainability & Energy Efficiency, Timber Buildings and Timber Products, Walls

Sign up:

Sign up: