BMBI: Flat Merchants’ July sales – volumes down, inflation up

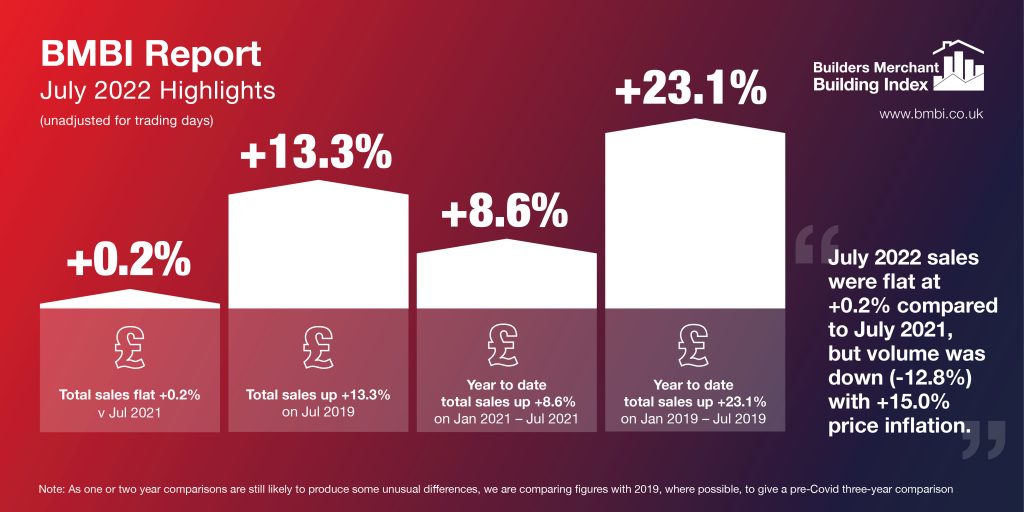

The latest figures from the Builders Merchant Building Index (BMBI), published in September, reveal that builders’ merchants’ value sales were virtually flat (+0.2%) in July 2022 compared to the same month in 2021. Trending down in previous months, volume sales were down (-12.8%) and price inflation remained high (+15.0%).

Ten of the twelve categories sold more in July 2022 compared to the previous year, including nine which outperformed Merchants overall. Renewables & Water Saving (+25.5%) Workwear & Safetywear (+20.2%), Kitchens & Bathrooms (+13.1%) and Plumbing, Heating & Electrical (+10.7%) did best. Only Landscaping (-4.6%) and Timber & Joinery Products (-14.4%) sold less.

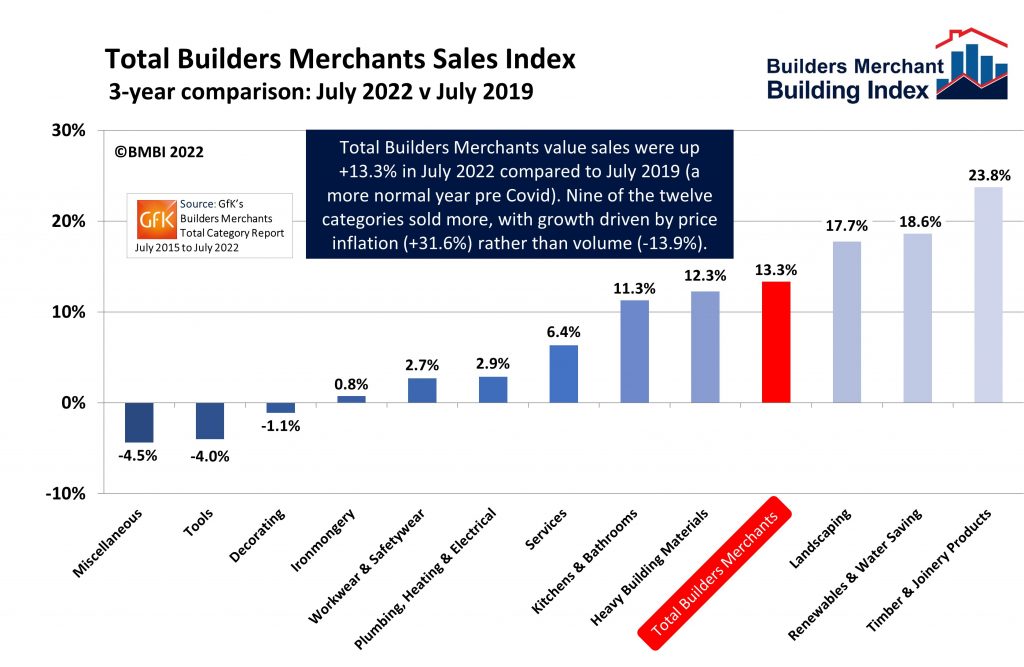

Compared to July 2019, a more normal pre-pandemic year, total merchant value sales were +13.3% higher. With two less trading days this year, like-for-like sales were up +24.1%. Three categories did better than total Merchants: Timber & Joinery Products (+23.8%), Renewables & Water Saving (+18.6%) and Landscaping (+17.7%). Heavy Building Materials (+12.3%), Kitchens & Bathrooms (+11.3%) and Plumbing, Heating & Electrical (+2.9%) all grew more slowly.

Year-to-date

Total sales in the period January to July 2022 were +8.6% higher than January to July 2021. Volume sales were -6.7% lower but prices were up +16.3%. With one less trading day this year, like-for-like sales were +9.3% higher. All categories sold more. Kitchens & Bathrooms (+20.8%) was strongest followed by Renewables & Water Saving (+20.7%), while Plumbing, Heating & Electrical (+12.7%), Heavy Building Materials (+12.0%) and Decorating (+9.3%) also grew more than merchants overall. Landscaping (+0.5%) was weakest.

Compared to the same period in 2019, sales were 23.1% higher. Price inflation was +26.7%, and volume was down -2.8%. With three less trading days in the most recent period like-for-like sales were +25.7% higher. Again, all categories sold more.

Month-on-month

Month-on-month, total merchant sales were down -2.6% in July compared to June 2022. Volume sales were down -5.2%. Prices rose +2.7%. With one more trading day in the most recent period, like-for-like sales were -7.3% lower. Renewables & Water Saving (+4.8%) was the strongest category month-on-month; Landscaping (-9.1%) was weakest.

Rolling 12-months

Total Merchants sales in the 12 months August 2021 to July 2022 were +20.4% higher than in the same 12 months three years earlier (August 2018 to July 2019). With two less trading days in the most recent period like-for-like sales were +21.3% higher. Eleven of the twelve categories sold more with Timber & Joinery Products (+39.1%) and Landscaping (+36.1%) well out in front.

Andy Scothern, Managing Director at eCommonSense and BMBI’s Expert for Website & Product Data Management Solutions, says: “It’s safe to say that businesses now realise that digitalisation and implementing eCommerce is crucial to growth and staying relevant in a quickly changing market.

“Whilst introducing new technology is undoubtedly an exciting development for any business and a marker of sustained growth and development, it’s worth also highlighting the ever-increasing cyber security risks.

“If cybercrime were a country, its economy would be the third largest in the world, behind the USA and China. Only a few months ago, we saw one of the world’s biggest building supply manufacturers, Knauf, issue a statement to the market announcing that it had been the victim of a cyber-attack.

“The attack was so big that they had been forced to close many of their systems for several days while they isolated the attack and assessed the damage.”

‘Disastrous consequences’

“Cyberattacks can have disastrous consequences. In 2022 the global average cost of a data breach hit an all-time high of $4.35 million for the organisations in the study.

“The cost of cyberattacks isn’t only financial, with companies having to spend time recovering from the attack, as well as re-establishing trust with customers and potentially repairing any subsequent damage to their brand.

“Online security is similar to climate change in that most people ignore it until they have been affected, and, by then, it is often, unfortunately, too late. Clearly, businesses seeking to digitalise their operations need to be partnering with software providers who understand the risks to ensure their businesses are protected.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

t: 01453 521 621

e: enquiries@bmbi.co.uk

Visit Supplier's page

Latest news

29th April 2025

CPD Courses Available Online From Ecological Building Systems

Ecological Building Systems, a leading supplier of natural building products for sustainable construction, has revealed its comprehensive CPD programme for the year ahead.

Posted in Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Continuing Professional Development (CPD's), Information Technology, Innovations & New Products, Insulation, Restoration & Refurbishment, Retrofit & Renovation, Seminars, Sustainability & Energy Efficiency, Training, Walls, Waste Management & Recycling

29th April 2025

WindowBASE launches new prospect databases at FIT Show

Visit WindowBASE at the FIT Show to see first-hand how it helps companies find new customers – the company is launching an easy-to-use, intuitive platform on Stand G16 at the NEC Birmingham from 29th April – 1st May.

Posted in Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Doors, Exhibitions and Conferences, Glass, Glazing, Information Technology, Innovations & New Products, Posts, Publications, Research & Materials Testing, Restoration & Refurbishment, Retrofit & Renovation, Windows

28th April 2025

Nuaire first UK ventilation manufacturer to use low carbon-emissions recycled & renewably produced steel

Nuaire has announced that its Magnelis® steel based ventilations systems are now being made from XCarb® recycled and renewably produced steel.

Posted in Air Conditioning, Articles, Building Industry News, Building Products & Structures, Building Services, Building Systems, Heating, Ventilation and Air Conditioning - HVAC, Restoration & Refurbishment, Retrofit & Renovation, Steel and Structural Frames, Sustainability & Energy Efficiency, Waste Management & Recycling

28th April 2025

Renderplas: Builders avoid costly remedial work with PVCu render beads

A pioneer of PVCu render beads, Renderplas is helping the construction industry avoid the costly remedial work associated with rusting steel designs…

Posted in Articles, Building Industry News, Building Products & Structures, Building Services, Building Systems, Facades, Posts, Render, Restoration & Refurbishment, Retrofit & Renovation, Sustainability & Energy Efficiency, Walls

Sign up:

Sign up: