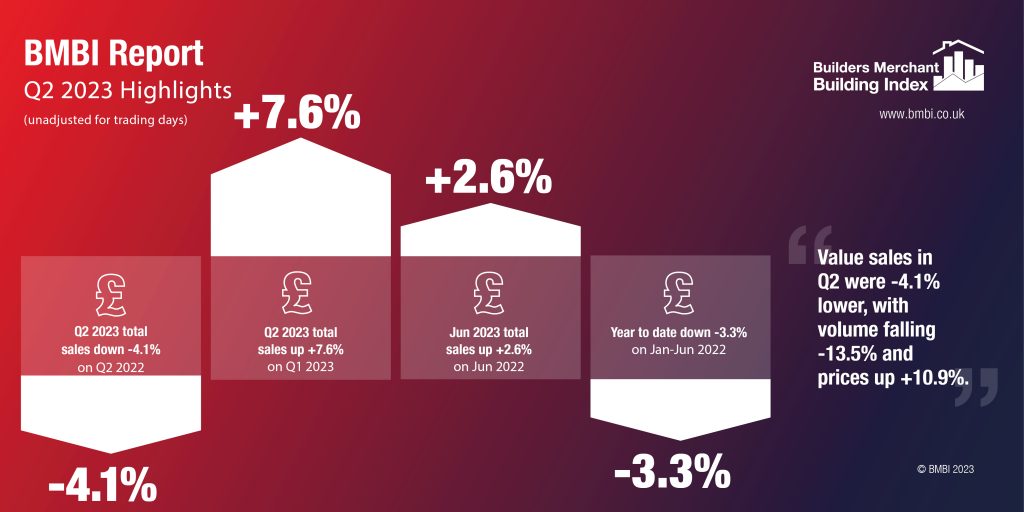

BMBI latest: Q2 value sales up +7.6% on Q1

The latest total value sales from Britain’s Builders’ Merchants released by the Builders Merchant Building Index (BMBI) show quarter-on-quarter sales climbed +7.6% in Q2 2023, in comparison to January to March 2023. Growth came from stronger volumes (+11.3%) as prices were -3.3% lower.

Quarter-on-quarter

Comparing Q2 to Q1 2023, six of the twelve categories had higher value sales, with seasonal category Landscaping (+47.3%) out in front, followed by Heavy Building Materials (+9.0%). Timber & Joinery Products (+2.1%) grew more slowly than merchants overall, while Plumbing Heating and Electrical (-12.2%) and Workwear & Safetywear (-12.7%) were the weakest categories.

With four less trading days in the most recent period, like-for-like sales were +14.8% higher.

Quarterly sales, Year-on-Year

Q2 2023 was down -4.1% on Q2 2022, with no difference in trading days. Volumes fell -13.5%, with prices up +10.9%.

Value sales increased in nine of the 12 categories in Q2 2023 compared to the previous year with Renewables & Water Saving (+44.4%) significantly ahead of the rest.

Decorating (+12.3%), Plumbing, Heating & Electrical (+9.1%) and Ironmongery (+6.1%) increased at a slower rate, and Heavy Building Materials (+0.5%) showed marginal value gain. Timber & Joinery Products (-16.3%) and Landscaping (-12.4%) both saw significant declines.

June sales, Year-on-Year

Total value sales for June were +2.6% ahead of the same month in 2022, helped by two extra trading days this year. Volume sales in June 2023 fell -5.4% year-on-year and prices rose +8.4%. Like-for-like sales were down -6.8% year-on-year. Two of the categories had their highest-ever monthly value sales: Decorating and Heavy Building Materials.

Nine of the twelve categories sold more with Renewables & Water Saving (+37.2%), again the strongest performer. Decorating (+18.3%), Plumbing, Heating & Electrical (+18.1%), and Heavy Building Materials (+6.7%) were among the other categories with higher value sales in June. Timber & Joinery Products (-10.2%) and Services (-12.9%) were weakest.

June sales, Month-on-Month

Compared to the previous month, June 2023 total merchant sales were +4.6% higher than May 2023. Growth was driven by a combination of higher volumes (+7.2%) and June having two more trading days. Prices were -2.5% lower in June than in May, and like-for-like sales were down -5.0%. Nine categories had higher value sales in June with Ironmongery (+7.1%) doing best, followed by Landscaping (+6.9%), Kitchens & Bathrooms and Tools (both +5.9%).

Last 12 months

July 2022 to June 2023 sales were the same as July 2021 to June 2022, with one less trading day in the most recent period. However, this parity masked a drop in volume -12.7%, which was offset by prices increasing +14.5%. Nine of the twelve categories sold more with Renewables & Water Saving the best performing category (+43.4%). Workwear & Safetywear (+14.2%), Plumbing, Heating & Electrical (+13.6%) and Heavy Building Materials (+5.8%) were among other categories with higher value sales. Timber & Joinery Products (-13.5%) was weakest.

Andrew Simpson, Packed Products Director for Hanson Cement and BMBI’s Expert for Cement & Aggregates, says: “After a sluggish first quarter, Q2 was better than expected for cement and aggregate sales particularly towards the end of June. However, volumes remain behind expectations.

“The latest figures from the Mineral Products Association show that lower construction demand led to a decline in Q2 sales with primary aggregates (-3.7%), asphalt (-3.1%), ready-mixed concrete (-5.2%) and mortar (-6.4%) all down compared to the previous quarter.

“At Hanson, our bulk sales have been quieter than expected but bagged products are now back on target for the year. This is reflective of the broader industry trends – while inflation and high interest rates mean that infrastructure projects have hit some (temporary) set backs and housebuilding remains a concern, there is still a demographic within the residential market which continues to spend on repair, maintenance and improvement projects.

Budget season

“As we head into budget season, continued demand uncertainty coupled with persistent cost inflation is making it difficult for many businesses to accurately predict what will be happening in H2 2023, let alone 2024. With a possible general election on the cards next year too, it’s a real challenge to forecast what factors will be influencing volumes in the near future.

“The recent changes to the extended producer responsibility for packaging regulations mean that reporting packaging data is now mandatory from August 2023. There was some relief for the industry though as the roll out of additional packaging fees has since been deferred for a year.

“That said, we are already seeing proactive merchants switching to our Multi-Cem Tough Bag cement in place of our single use plastic bagged cement. We expect more merchants to switch in the coming months to stay ahead of the cost increases associated with plastic packaging – and to reduce their impact on the environment of course.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

t: 01453 521 621

e: enquiries@bmbi.co.uk

Visit Supplier's page

Latest news

28th April 2025

Ideal Heating Commercial takes extra care with the heat network at Huddersfield specialist housing development

Ideal Heating Commercial POD Heat Interface Units (HIUs) and Evomax 2 condensing boilers have been installed into Ash View Extra Care in Huddersfield.

Posted in Articles, Building Industry News, Building Products & Structures, Building Services, Case Studies, Facility Management & Building Services, Heating Systems, Controls and Management, Heating, Ventilation and Air Conditioning - HVAC, Pipes & Fittings, Plumbing, Restoration & Refurbishment, Retrofit & Renovation

25th April 2025

Quicker and Easier Inspections with High Performance FLIR Testing Solutions

FLIR, a Teledyne Technologies company, introduces its PV range of inspection solutions to expedite panel installation and maintenance at solar farms, commercial buildings, and residential buildings.

Posted in Articles, Building Industry News, Building Products & Structures, Building Services, Facility Management & Building Services, Information Technology, Innovations & New Products, Research & Materials Testing, Restoration & Refurbishment, Retrofit & Renovation, Sustainability & Energy Efficiency, Thermal Imaging and Monitors

25th April 2025

Schlüter-Systems: Common costly mistakes when renovating a bathroom

With nearly six decades of experience in the bathroom world, Schlüter-Systems knows all there is to know about the challenges of installing a perfect one!

Posted in Articles, Bathrooms & Toilets, Bathrooms, Bedrooms & Washrooms, Building Industry News, Building Products & Structures, Building Services, Damp & Waterproofing, Drainage, Drainage Services, Drainage, Guttering, Soffits & Fascias, Heating, Ventilation and Air Conditioning - HVAC, Interior Design & Construction, Interiors, Membranes, Pipes & Fittings, Plumbing, Restoration & Refurbishment, Retrofit & Renovation, Walls

25th April 2025

Newcastle United enhances fans’ experience with Stannah escalators

Newcastle United Football Club has introduced two new Stannah escalators as part of a refurbishment of its on-site merchandising outlet.

Posted in Accessibility, Articles, Building Industry News, Building Products & Structures, Building Services, Case Studies, Facility Management & Building Services, Restoration & Refurbishment, Retrofit & Renovation

Sign up:

Sign up: