BMBI: Merchant value sales fall again in May

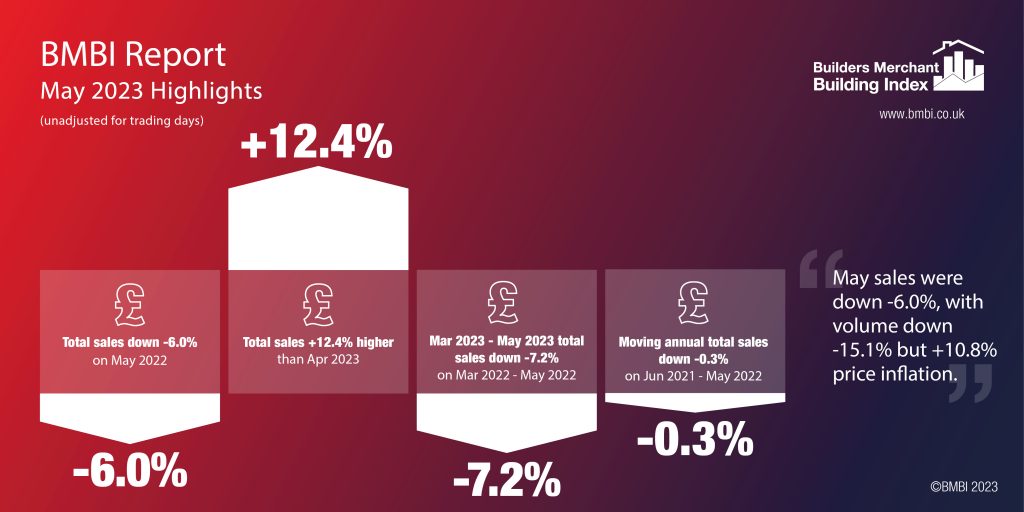

The latest figures from the Builders Merchant Building Index (BMBI), published in July, reveal builders’ merchants’ value sales were down by -6.0% in May, compared to the same month in 2022.

Volume sales fell -15.1% with price inflation of +10.8%. With one less trading day in May 2023, like-for-like sales were -1.3% lower.

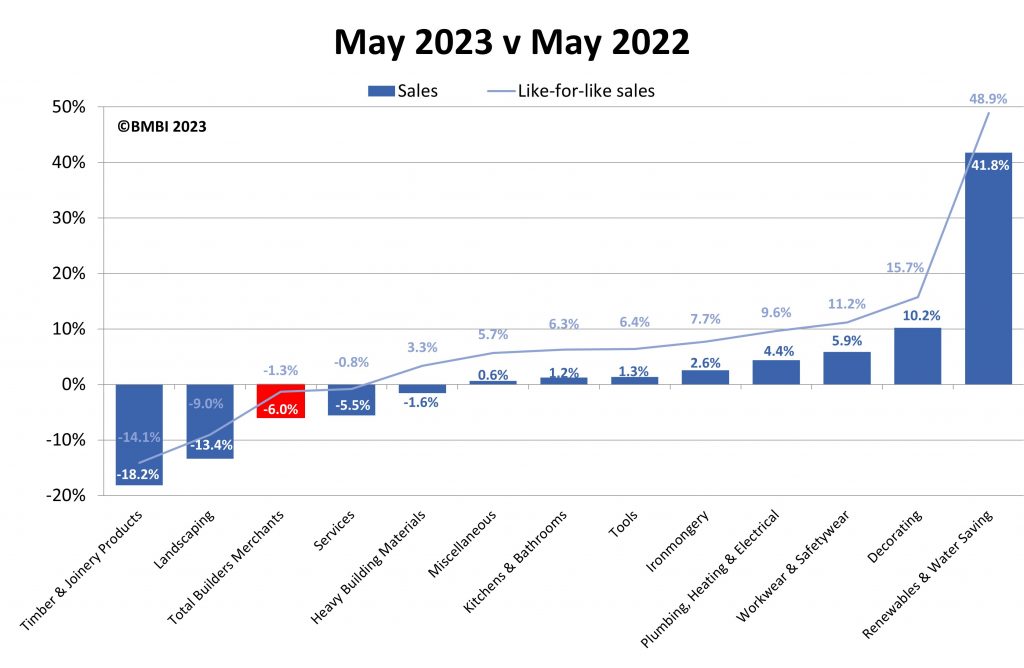

Eight of the twelve categories sold more this year than in May 2022. Renewables & Water Saving (+41.8%) grew the most, followed by Decorating (+10.2%) and Workwear & Safetywear (+5.9%). Heavy Building Materials (-1.6%), Landscaping (-13.4%) and Timber & Joinery Products (-18.2%) were all down year on year.

Month on month

Month-on-month, total merchant sales climbed +12.4% in May compared to April 2023. Volume sales were up +14.1% while prices decreased slightly (-1.5%). With two extra trading days in May, like-for-like value sales were up +1.1%. All categories sold more with Landscaping (+18.6%) and Heavy Building Materials (+13.3%) growing the most. Workwear & Safetywear (+11.3%), Decorating (+10.7%), Timber & Joinery Products (+10.6%) and Ironmongery (+10.3%) also hit double digit growth, while Plumbing, Heating & Electrical (+7.1%) and Tools (+7.2%) grew the least.

Rolling 12-months

Total merchant sales in the twelve months from June 2022 to May 2023 were -0.3% lower than the same period a year ago, with volumes down -13.6% and price inflation of +15.4%. With five less trading days in the most recent period, like-for-like sales were +1.8% higher. Ten of the twelve categories sold more with Renewables & Water Saving (+41.0%) outperforming the other categories by some margin. Workwear & Safetywear (+14.3%),

Plumbing, Heating & Electrical (+12.2%), Decorating (+11.6%) and Kitchens & Bathrooms (+11.0%) also made double figures. Heavy Building Materials (+5.7%) grew more slowly. Landscaping (-10.4%) and Timber & Joinery Products (-13.6%) sold less.

Andrew Simpson, Packed Products Director Hanson Cement and BMBI’s Expert for Cement & Aggregates, says: “Low consumer confidence and higher mortgage rates have affected housebuilders’ expectations, and some of the largest sharply pegged back their forward build programmes, and reduced housebuilding starts which reduced heavy aggregate volumes at the start of the year.

“Inflation impacted the delivery of infrastructure works, with major projects like HS2 being delayed. Wages and material costs continue to cause issues across the board.

“Our challenges don’t stop at cost pressures. Sustainability is our biggest challenge by far. Changes to the extended producer responsibility for packaging rules means more businesses now need to comply, undoubtedly leading to a sharp increase in packaging costs.

‘Efforts are being noticed’

“Cement is an energy intensive manufacturing business, and we have a way to go to decarbonise our operations, but our efforts are being noticed: Hanson recently scooped the Caring for the Environment award from the Worshipful Company of Builders Merchants and we shared our progress and what we’ve learned on our journey at our ‘Let’s Talk Sustainability’ online event earlier this year.

“There is also better news afoot. According to the Mineral Products Association, there was a rebound in sales at the start of the year after the sharp losses seen in the second half of 2022. Primary aggregates sales stabilised (+3.3%), while asphalt (+1.8%) returned to quarter-on-quarter growth after three consecutive declines. Ready-mixed concrete sales grew (+9.8%) and mortar (+6.0%) sales also picked up after a poor end to 2022.

“The Office of Budget Responsibility (OBR) remains upbeat about the outlook for the UK, predicting growth from the second half of 2023. The general feeling in the industry is one of optimism, as better weather ushers in a boost in sales and the ‘green shoots’ of change.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

t: 01453 521 621

e: enquiries@bmbi.co.uk

Visit Supplier's page

Latest news

28th April 2025

Nuaire first UK ventilation manufacturer to use low carbon-emissions recycled & renewably produced steel

Nuaire has announced that its Magnelis® steel based ventilations systems are now being made from XCarb® recycled and renewably produced steel.

Posted in Air Conditioning, Articles, Building Industry News, Building Products & Structures, Building Services, Building Systems, Heating, Ventilation and Air Conditioning - HVAC, Restoration & Refurbishment, Retrofit & Renovation, Steel and Structural Frames, Sustainability & Energy Efficiency, Waste Management & Recycling

28th April 2025

Renderplas: Builders avoid costly remedial work with PVCu render beads

A pioneer of PVCu render beads, Renderplas is helping the construction industry avoid the costly remedial work associated with rusting steel designs…

Posted in Articles, Building Industry News, Building Products & Structures, Building Services, Building Systems, Facades, Posts, Render, Restoration & Refurbishment, Retrofit & Renovation, Sustainability & Energy Efficiency, Walls

28th April 2025

How Celotex’s Technical Team adds value through expert insulation support

From U-value calculations to real-world installation support, Celotex’s technical team helps construction professionals specify and install insulation with confidence…

Posted in Articles, Building Industry News, Building Products & Structures, Building Services, Insulation, Research & Materials Testing, Restoration & Refurbishment, Retrofit & Renovation, Sustainability & Energy Efficiency, Walls

28th April 2025

Ideal Heating Commercial takes extra care with the heat network at Huddersfield specialist housing development

Ideal Heating Commercial POD Heat Interface Units (HIUs) and Evomax 2 condensing boilers have been installed into Ash View Extra Care in Huddersfield.

Posted in Articles, Building Industry News, Building Products & Structures, Building Services, Case Studies, Facility Management & Building Services, Heating Systems, Controls and Management, Heating, Ventilation and Air Conditioning - HVAC, Pipes & Fittings, Plumbing, Restoration & Refurbishment, Retrofit & Renovation

Sign up:

Sign up: