BMBI: Merchant volumes fall again but price inflation drives a record-breaking Q2

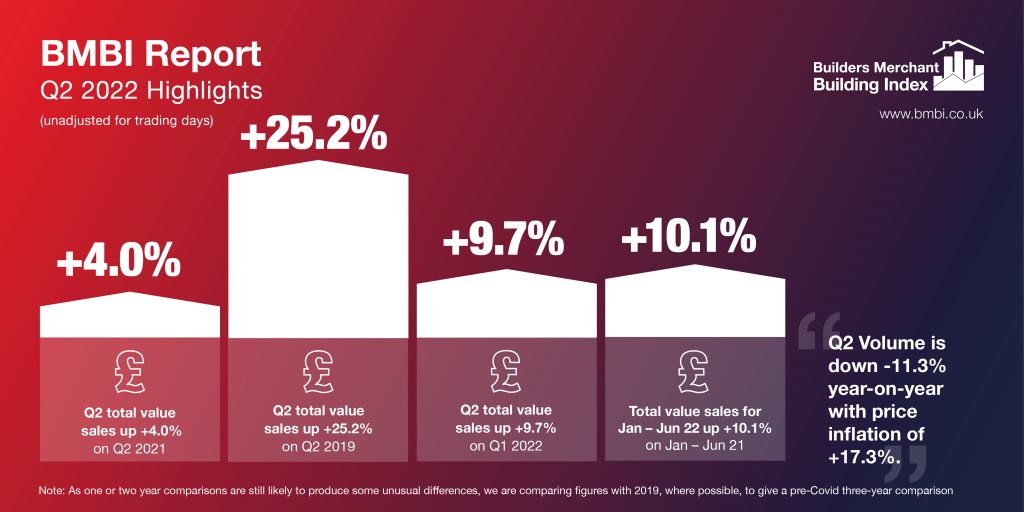

The latest total value sales data from Britain’s Builders’ Merchants shows Q2 2022 recorded the highest revenue since the BMBI started, despite lacklustre June sales. However, with Q2 volumes falling -11.3% compared with Q2 2021, +17.3% price inflation is behind the record-breaking growth.

Quarterly sales, Year-on-Year

Quarter 2 2022 total value sales were +4.0% higher than Q2 2021, with one less trading day this year. Ten of the 12 categories sold more with Kitchens & Bathrooms (+18.5%), Heavy Building Materials (+9.2%), Decorating (+7.0%), Tools (+2.9%) and Ironmongery (+1.3%) all having their best-ever quarterly sales. Only Timber & Joinery Products (-3.0%) and Landscaping (-6.3%) sold less.

Comparing Q2 2022 with Q2 2019, a more normal pre-COVID trading year, total value sales were +25.2% higher this year, but volume sales were -2.7% down while prices were up +28.7%. Despite one less trading day, like-for-like sales were +27.3% higher. All categories sold more.

Quarter-on-quarter

Quarter-on-quarter, sales were up +9.7% in Q2 2022 compared to Q1 2022. Volume sales were +7.9% higher and prices were up +1.6%. Like-for-like sales were +15.1% higher in Q2, despite three less trading days in the most recent quarter. Seasonal category Landscaping (+37.4%) was considerably ahead while Heavy Building Materials (+12.1%) was the only other category growing faster than total Merchants.

June sales, Year-on-Year

The exceptional revenues seen in Q2 came in spite of falling year-on-year sales in June (-1.0%). Volume sales for the month were -15.3% lower with prices up +17.0% compared to the same month in 2021. With two less trading days this year, like-for-like sales were up +8.9%. Nine of the twelve categories sold more, led by Kitchens & Bathrooms (+10.8%) and Renewables & Water Saving (+7.7%).

Total value sales in June 2022 were +31.0% higher than the same month three years ago, with no difference in trading days. All categories sold more than June 2019, with Landscaping (+44.5%) and Timber & Joinery Products (+40.3%) performing the best.

June sales, Month-on-Month

Total merchant sales in June were -4.2% down compared to the previous month. Volume sales were -3.7% lower than May, with prices down -0.6%. Eleven of the 12 categories sold less, with only Workwear & Safetywear (+4.2%) selling more. Decorating (-1.7%), Heavy Building Materials (-2.8%) and Kitchens & Bathrooms (-4.1%) all fared better than Builders Merchants overall.

Last 12 months

Sales in the 12 months from July 2021 to June 2022 were +12.9% higher than in the same 12 months a year earlier, with two less trading days this year. Eleven categories sold more. Timber & Joinery Products (+20.3%) and Kitchens & Bathrooms (+16.7%) were the strongest categories, while Heavy Building Materials (+12.1%) and Plumbing, Heating & Electrical (+11.8%) grew more slowly.

Krystal Williams, Managing Director at Pavestone and BMBI’s Expert for Natural Stone & Porcelain Paving, says: “The market for porcelain continues to grow, while sales of sandstone are still in decline. Good quality porcelain is now cheaper to buy than natural sandstone, so it’s an obvious choice for landscapers and consumers.

Krystal Williams, Managing Director at Pavestone and BMBI’s Expert for Natural Stone & Porcelain Paving, says: “The market for porcelain continues to grow, while sales of sandstone are still in decline. Good quality porcelain is now cheaper to buy than natural sandstone, so it’s an obvious choice for landscapers and consumers.

“Supplies of European porcelain are now stable, particularly with stock from Spain and Italy. This has made up for the difficulties in getting porcelain from Poland, where our supplier was located on the Ukraine border.

“Shipping prices are finally reducing, but this seems more difficult to manage than when prices were going up! Like everyone in the supply chain, we are left with stock which is now worth less than it was when we bought it.

Consumer confidence

Krystal continues: “Consumer confidence is at its lowest since records began (-41 in July falling to -44 in August). That said, the top end of the market, which is financially secure, continue to spend on landscaping and garden projects. Good landscapers are still fully booked into next year, so there is a pipeline of demand. At the bottom end, the decline in sales is likely to fall further as people struggle to get by.

“This leaves middle earners where there is potential for growth for DIY. Stockists say retail sales are falling – possibly due to holidays – but these could return depending on the impact of energy increases. Those middle earners with a bit of money are more likely to do it themselves and save money on labour rather than the product.

“Looking ahead, reducing demand may raise competitiveness between merchants. So keep stocks plentiful, as customers will go elsewhere if you don’t have what they need when they need it.

“Sustainability remains a concern and our policy now is only to use electric vehicles as company cars. It’s difficult to cut emissions due to the nature of our products but we continue to look for ways to offset this.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

t: 01453 521 621

e: enquiries@bmbi.co.uk

Visit Supplier's page

Latest news

11th April 2025

Don’t Do a Dave! It’s Time to Lock FIT Show 2025 in Your Calendar!

It’s that time again – FIT Show is back! You could be forgiven for thinking there won’t be much new to see when FIT Show returns to the NEC from 29 April – 1 May. Wrong!

Posted in Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Continuing Professional Development (CPD's), Exhibitions and Conferences, Information Technology, Innovations & New Products, Restoration & Refurbishment, Retrofit & Renovation, Seminars, Training

11th April 2025

Insight Data: Boost construction success with project and prospect data

For those working in construction – in whatever capacity – the last few years haven’t been much fun. And according to the latest statistics, it would seem the challenges are continuing – Alex Tremlett, Insight Data’s Commercial Director, has more…

Posted in Articles, Building Industry News, Building Services, Information Technology, news, Research & Materials Testing

11th April 2025

ASSA ABLOY EMEIA: Learn how to tackle the security challenges of digitalising access with insights from industry experts

In a new series of videos, experts in various specialisms within ASSA ABLOY share their expertise on digital access, including the complexities to overcome and the range of benefits for those who get digital access right…

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Information Technology, Innovations & New Products, Posts, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection, Videos

10th April 2025

Geberit completes 150 Acts of Kindness

Geberit has raised nearly £14,000 for various charities through its ‘150 Acts of Kindness’ initiative, a year-long programme of fundraising and volunteering to mark the company’s 150th anniversary in 2024.

Posted in Articles, Bathrooms & Toilets, Bathrooms, Bedrooms & Washrooms, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Charity work, Drainage, Interiors, Pipes, Pipes & Fittings, Plumbing, Restoration & Refurbishment, Retrofit & Renovation

Sign up:

Sign up: