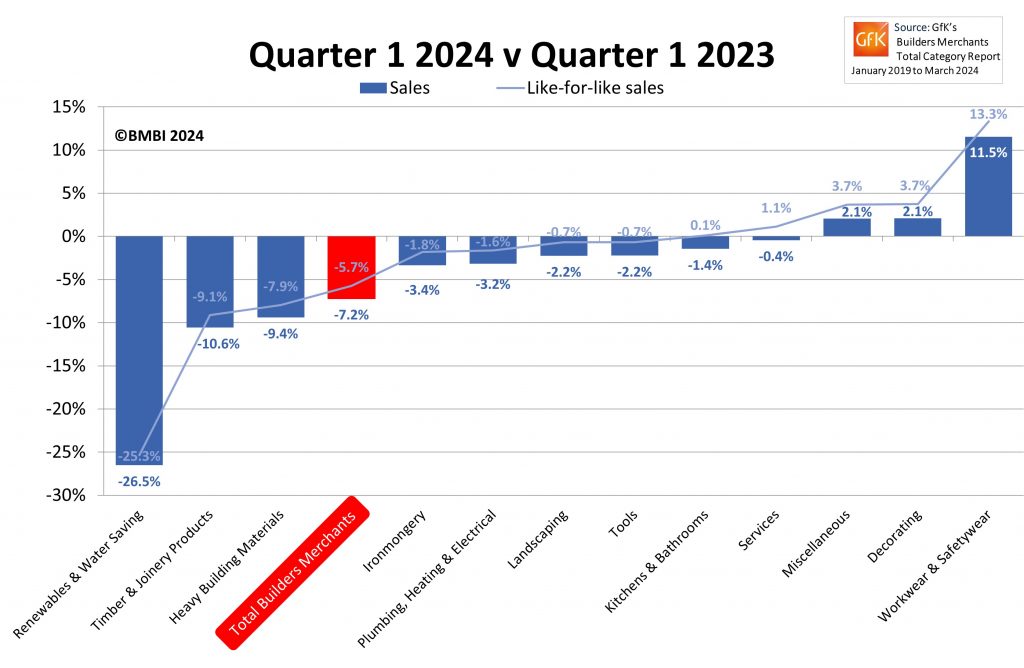

The latest total value sales figures from Builders Merchant Building Index (BMBI) show Q1 2024 sales were -7.2% lower than Q1 2023, with volume sales falling -8.7% and prices edging up +1.6%. With one less trading day in Q1 2024, like-for-like sales (which take the number of trading days into account) were -5.7% lower.

Just three of the twelve categories sold more in Q1, year-on-year. The two largest categories, Timber & Joinery Products (-10.6%) and Heavy Building Materials (-9.4%), both sold less.

Quarter-on-quarter

Total value sales for Q1 2024 were up +3.5% compared to Q4 2023. Volume sales were +3.9% higher and prices were flat (-0.4%). With three additional trading days in the most recent period, like-for-like sales were -1.4% lower. All but one category sold more with Landscaping (+14.6%) growing the most, followed by Tools (+6.0%). Renewables & Water Saving (-6.6%) was the only category to sell less.

March sales Year-on-Year

Total value sales for March 2024 fell -13.6% compared to March 2023. Volume sales dropped -14.0% while prices edged up +0.5%. With three less trading days in March this year, like-for-like sales were -0.6% lower. All categories sold less. The two largest categories – Heavy Building Materials (-15.2%) and Timber & Joinery Products (-17.7%) – were significantly down compared to the same month last year.

March sales, Month-on-Month

Total Merchants sales were +3.7% higher in March 2024 than in February 2024. Volume sales were up +4.7% and price was down -1.0%. Half of the twelve categories sold more with two of the largest categories, Landscaping (+20.1%) and Heavy Building Materials (+3.9%), outperforming Total Merchants. Plumbing Heating & Electrical (-4.1%) and Renewables & Water Saving (-4.7%) lagged other categories.

Last 12 months

Total Merchants sales in the 12 months from April 2023 to March 2024 were -5.9% lower than the same 12-month period a year earlier. Volume sales dropped -11.8% while prices climbed +6.6%. Eight of the twelve categories sold more, however the three largest categories, Heavy Building Materials (-5.7%), Landscaping (-8.4%) and Timber & Joinery Products (-13.2%), all sold less.

Andrew Simpson, Packed Products Director at Heidelberg Materials and BMBI’s Expert for Cement & Aggregates, says…

“It has been a quieter than expected start to the year with the continued inclement weather, market uncertainty and low demand for RMI all impacting cement and aggregates demand.

“The latest market figures, published by Mineral Products Association, show mortar sales are at their lowest since 2014 (excluding Q2 2020), declining -27.5% between Q2 2022 and Q1 2024. Ready mixed concrete has plummeted to historically low levels, down -5.7% quarter-on-quarter. Demand for asphalt (-2.6%) and mortar (-2.7%) also declined compared to Q4 2023, while primary aggregates was the only subcategory to grow (+1.1%).

“From conversations with customers, it’s evident everyone’s margins are under pressure. Low construction demand means merchants are competing for the same work, and as suppliers, we are facing increased costs that we are reluctant to pass on. The Government says inflation is falling, but it’s not being felt by consumers and prices still seem to be climbing.

“That said, merchants are also telling us that when the sun comes out, footfall into branches increases and contractors say their order books are starting to fill up again. A bounce-back is surely on the horizon. Expect Q2 sales to fly once the rain clouds in the sky – and over the economy – clear.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.