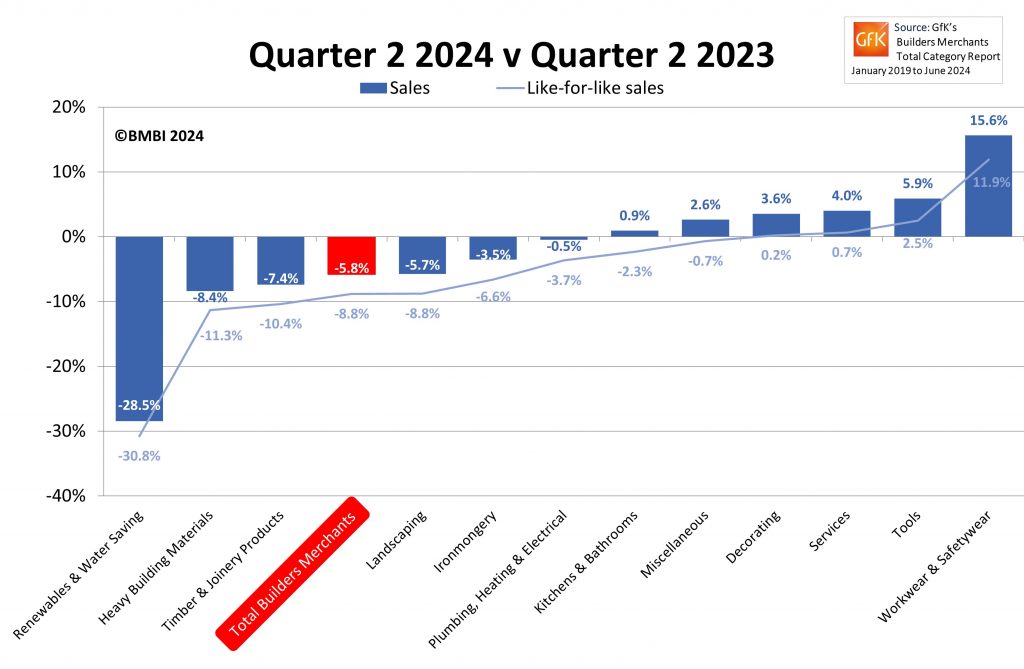

BMBI: Q2 Merchant value sales down -5.8% on Q2 2023. June volumes weak.

The latest total value sales figures from Builders Merchant Building Index (BMBI) show that sales for Q2 2024 were down -5.8% compared to Q2 2023, with volume sales down -7.2% and prices up +1.5%. With two extra trading days this year, like-for-like sales (which take the number of trading days into account) were -8.8% lower.

Half of the twelve categories sold more in Q2 2024, with Workwear & Safetywear up +15.6%, but the two largest categories – Timber & Joinery Products (-7.4%) and Heavy Building Materials (-8.4%) – were both down more than total merchants. Renewables & Water Saving (-28.5%) was the weakest category.

Quarter-on-quarter

Total value sales for Q2 2024 were up +9.5% compared to Q1. Volume sales were +13.8% higher, while prices were -3.8% lower. With one less trading day in the most recent period, like-for-like sales were up +11.2%. Eight of the twelve categories sold more with seasonal category Landscaping (+43.4%) growing strongly. Services (+11.0%) and Heavy Building Materials (+10.3%) increased more than most. Workwear & Safetywear (-9.9%) and Plumbing Heating & Electrical (-10.6%) were the weakest.

June sales Year-on-Year

Quarter 2 total value sales were impacted negatively by weak June sales which were down -14.7% compared to the same month in 2023. Volume sales were down -16.9% and prices were up +2.7%. With two less trading days in June this year, like-for-like sales were -6.2% lower. Sales of the three largest categories – Timber & Joinery Products (-15.5%), Landscaping (-16.4%) and Heavy Building Materials (-17.2%) – fell more than total merchants.

June sales, Month-on-Month

Total Merchants sales were -6.0 % lower in June 2024 compared to May 2024. Volume sales were down -4.4% and price was also down -1.7%. Only Renewables & Water Saving (+5.5%) sold more. Timber & Joinery Products (-5.7%) and Heavy Building Materials (-5.6%) performed marginally better than total merchants.

Last 12 months

Total Merchants sales in the 12 months from July 2023 to June 2024 were -6.1% lower than the same 12-month period a year earlier. Volume sales fell -10.0% and prices rose +4.4%.

Year to date

Total value sales in the six months January to June were -6.4% down on the same period in 2023. Volumes were down -7.8% and prices up +1.5%.

Derrick McFarland, Managing Director for Keystone Group UK and BMBI’s Expert for Steel Lintels, says: “The second quarter of 2024 has brought out the sunshine after a wet Q1, however in terms of volumes there’s no excitement, rather the market could be described as stable. That said, housebuilding is a significant contributor to the UK economy, and with the new government’s ambitions of delivering 1.5m homes over the next 5 years, these could be exciting times.

“The mortgage rate is forecast to go down again in 2024. Although further cuts may take longer to arrive than liked, they are, as the CPA puts it, the catalysts for a recovery in the two largest sectors of construction, private housing and private housing RMI, and they will help support any future uplift in house sales.

“The new building regulations offer homebuyers a distinctive choice in terms of energy efficiency compared to older properties. New home buyers are more likely to put the environment as the keystone of their decision making.

“With a continuing and severe skills shortage in construction, destined to get worse as an older cohort of the workforce retires without being replaced, opportunities to meet demand within manufacturing will rely on continued investment in automation.

“We have to be forward thinking and optimistic for the future, tinged with a fair degree of patience.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

t: 01453 521 621

e: enquiries@bmbi.co.uk

Visit Supplier's page

Latest news

29th April 2025

Senior pledges to ‘bee’ part of the solution with new biodiversity initiative

Senior Architectural Systems has installed its first on-site beehive, marking another step forward in its commitment to sustainability and biodiversity.

Posted in Articles, Building Industry News, Building Products & Structures, Building Services, Curtain Walling, Doors, Glass, Glazing, Innovations & New Products, news, Restoration & Refurbishment, Retrofit & Renovation, Sustainability & Energy Efficiency, Walls, Windows

29th April 2025

West Fraser range delivering key benefits for South-East carpentry company

An experienced carpenter and building site manager who has recently set up his own company is using high performance panel products from the West Fraser range.

Posted in Articles, Building Industry News, Building Products & Structures, Building Systems, Case Studies, Garden, Restoration & Refurbishment, Retrofit & Renovation, Sustainability & Energy Efficiency, Timber Buildings and Timber Products

29th April 2025

CPD Courses Available Online From Ecological Building Systems

Ecological Building Systems, a leading supplier of natural building products for sustainable construction, has revealed its comprehensive CPD programme for the year ahead.

Posted in Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Continuing Professional Development (CPD's), Information Technology, Innovations & New Products, Insulation, Restoration & Refurbishment, Retrofit & Renovation, Seminars, Sustainability & Energy Efficiency, Training, Walls, Waste Management & Recycling

29th April 2025

WindowBASE launches new prospect databases at FIT Show

Visit WindowBASE at the FIT Show to see first-hand how it helps companies find new customers – the company is launching an easy-to-use, intuitive platform on Stand G16 at the NEC Birmingham from 29th April – 1st May.

Posted in Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Doors, Exhibitions and Conferences, Glass, Glazing, Information Technology, Innovations & New Products, Posts, Publications, Research & Materials Testing, Restoration & Refurbishment, Retrofit & Renovation, Windows

Sign up:

Sign up: