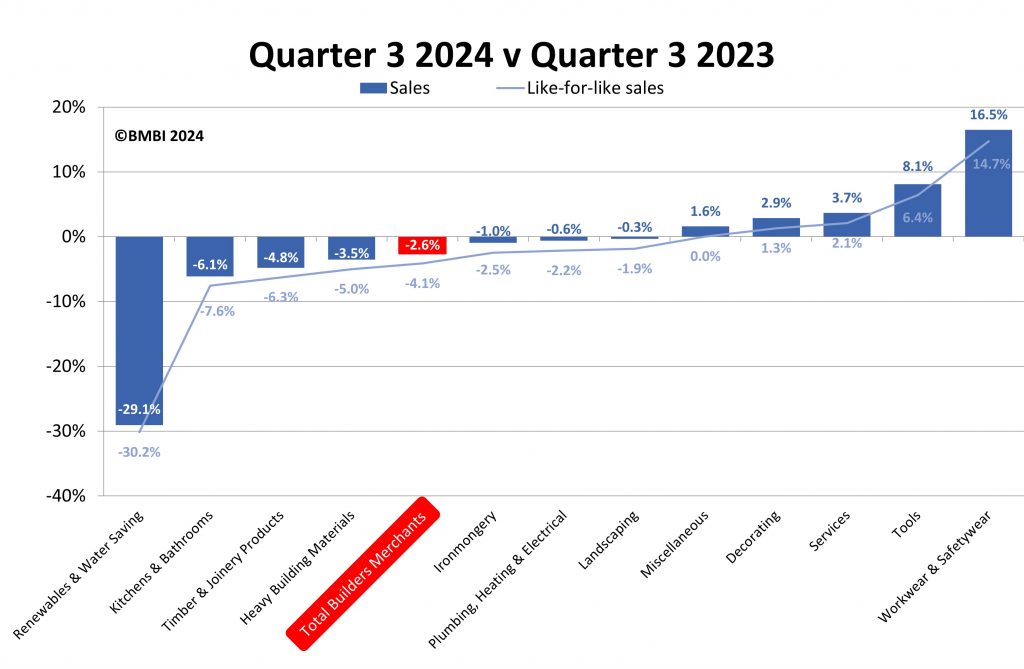

The latest total value sales figures from Builders Merchant Building Index (BMBI) show that sales for Q3 2024 were down -2.6% compared to Q3 2023, with volume sales down -2.8% and prices virtually the same (+0.2%). With one additional trading day this year, like-for-like sales (which take the number of trading days into account) were -4.1% lower.

Five of the twelve categories sold more in Q3 2024, led by Workwear & Safetywear (+16.5%). The two largest categories – Timber & Joinery Products (-4.8%) and Heavy Building Materials (-3.5%) – were both down more than total merchants.

Quarter-on-quarter

Total value sales for Q3 2024 were up +1.7% on Q2 2024. Volumes increased +2.3%, while prices were down -0.6%. Ten categories sold more quarter-on-quarter with Workwear & Safetywear (+6.6%) growing most followed by Ironmongery (+3.8%) and Services (+3.6%). Heavy Building Materials (+3.2%) also fared better than Total Merchants. Landscaping (-9.3%) and Kitchens & Bathrooms (-0.1%) were the weakest categories. With three more trading days in the most recent period, like-for-like sales were -3.0% lower.

September sales Year-on-Year

Quarter 3 total value sales weren’t helped by September value sales, down -3.5% year-on-year. Volume sales were also down -3.6% and price was virtually the same (+0.1%). Timber & Joinery Products (-5.6%) and Heavy Building Materials (-4.3%) both declined more than Total Merchants.

September sales, Month-on-Month

Value sales for September were weak compared to August (-1.7%). Month-on-month, volume sales were down -0.7% and prices also decreased -1.0%. Just four categories sold more while Heavy Building Materials (-1.6%) was roughly on par with Total Merchants.

Last 12 months

Total Merchants sales in the 12 months from October 2023 to September 2024 were -5.2% lower than the same 12-month period a year earlier. Volume sales decreased -7.5% and prices were up +2.4%.

Year to date

Total value sales for January to September were -5.1% below the same period in 2023. With two more trading days this year, like-for-like sales were down -6.1%.

Paul Edworthy, Commercial Lead: Builders Merchant Group, Dulux Trade and BMBI’s Expert for Paint, says…

“In Q3 the trade paint market showed signs of recovery, with MAT growth improving to -1.5%, largely driven by a +1.6% year-on-year increase in Q3 volume sales. The uplift was primarily influenced by a delayed start to projects due to previously poor weather, with activity in the paint industry showing the expected lag as paint goes on last.

“The release of the first Labour budget has impacted consumer confidence, signalling inflation is going to stay higher for longer with mortgage rates likely to remain elevated for an extended period. This is dampening an otherwise growing optimism for a construction market rebound.

“That optimism was further knocked by the recent collapse of ISG, which sent shockwaves across the industry. Despite these challenges, the Construction Products Association (CPA) has updated its forecast, predicting a -2.9% decline in construction output in 2024, followed by a 2.5% increase in 2025 and further growth in 2026.

“As the second largest sector within the market, Private Housing RMI remains significantly down. Professional painter and decorator booking trends, heavily influenced by seasonal patterns, are down compared to last year, with London experiencing particularly subdued activity. The newbuild sector has faced a challenging year, with forecasts indicating a resurgence in 2025 as market conditions improve.

“Volume growth in non-housing RMI has stabilised following a surge of commercial investments preparing for events and seasonal activities in offices, educational facilities, and social housing. This segment appears to have benefitted from increased spending earlier in the year.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.