BMBI: Timber & Joinery fuels builders’ merchants’ sales growth in July

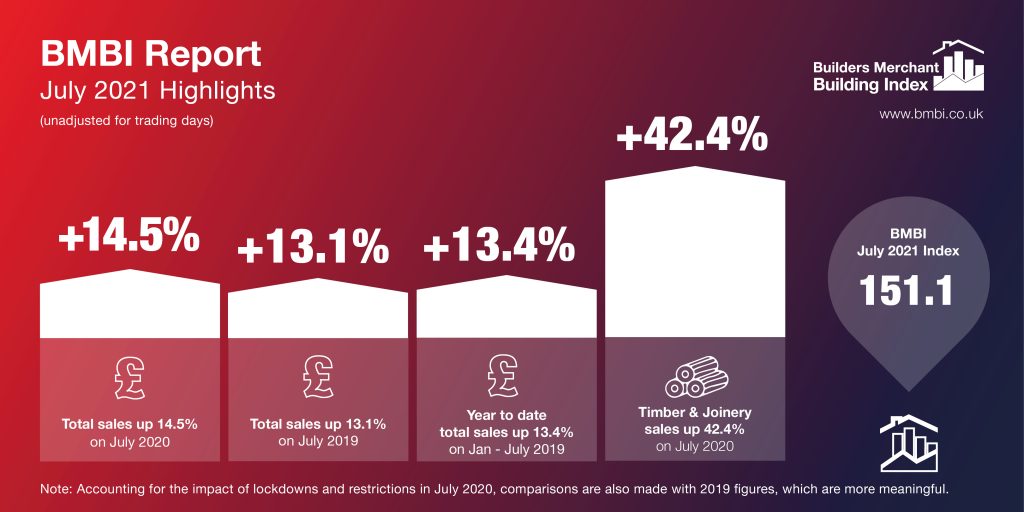

The latest figures from the Builders Merchant Building Index (BMBI) reveal that builders’ merchants’ year-on-year value sales to builders and contractors were 14.5% higher in July 2021 than the same month last year, with two less trading days. Average daily sales in July climbed 25.5%.

Total merchants value sales over the 12 month period were helped by Timber & Joinery Products (+42.4%) recording its highest ever monthly sales since the BMBI report began. Kitchens & Bathrooms (+13.9%) chalked up its highest sales for 12 months. Plumbing, Heating & Electrical (+10.4%) and Heavy Building Materials (+8.9%) also performed well compared to the same month a year ago.

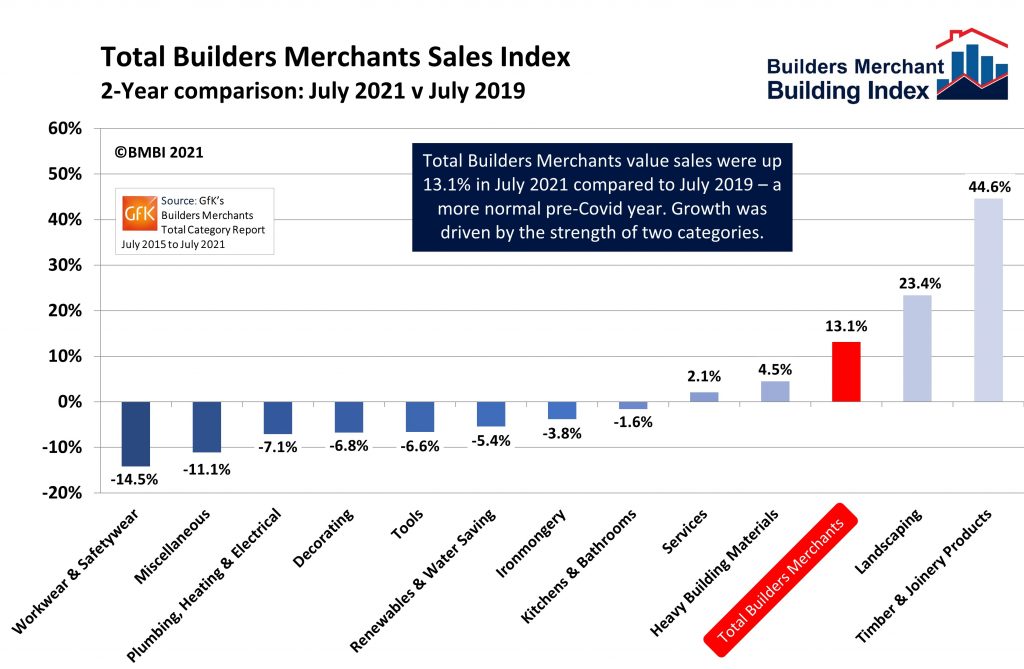

Compared to July 2019, a more normal pre-pandemic year, total merchants sales in July 2021 were up 13.1%, with two less trading years this year. Much of this growth was driven by just two categories – Timber & Joinery (+44.6%) and Landscaping (+23.4%).

Last three months

Total value sales in May to July 2021 were 35.4% higher than the same three months in 2020, with two less trading days this year. Product categories leading the field included Timber & Joinery Products (+64.8%), Kitchens & Bathrooms (+50.0%), Renewables & Water Saving (+48.8%), Plumbing, Heating & Electrical (+46.5%) and Tools (+38.7%). Total sales were also up on the same three months of 2019 (+17.3%).

Month-on-month

After a bumper June, total merchants sales were 3.8% lower month-on-month, with one less trading day in July. Kitchens and Bathrooms increased marginally (+1.1%), while Timber & Joinery Products was flat (+0.1%). Other categories sold less than the previous month including Heavy Building Materials (-4.2%), Plumbing, Heating & Electrical (-8.1%) and Landscaping (-12.9%). Workwear & Safetywear (-17.0%) was the weakest category.

Year-to-date

Total value sales in January to July 2021 were up 42.4% compared to the same seven months of 2020. Sales were also up on January to July 2019 (+13.4%).

Index

July’s BMBI index was 151.1 with strong performances form Landscaping (204.8) and Timber & Joinery Products (199.8). Seven other categories exceeded 100 including Heavy Building Materials (136.8), Ironmongery (129.2) and Kitchens & Bathrooms (126.5).

Derrick McFarland, Managing Director Keystone Group UK and BMBI’s Expert for Steel Lintels (pictured above), comments:

“The house building sector plays a key role in supporting the economic recovery. However, as demand has increased, supply constraints are pushing up price inflation. House price rises, temporarily fuelled by stamp duty cuts, will see the speed of growth slow but stay strong. The imbalance of demand versus new properties coming to market will keep house prices high in the coming months.

“While positive, we should be concerned about escalating material and labour costs, which may have a huge impact on the continuation of planned projects.

“Since last autumn, steel shortages have severely restricted the volumes of steel lintels available to the market. Having said this, Keystone delivered Q2 volumes in line with those in the same period during 2019, although supply may not have been as smooth as it was before the pandemic.

“All businesses are having to manage stampeding demand, continuing risks of Covid-19, labour availability shortages, and staff deserving of a well-earned staycation, or a trip to somewhere ‘green’.

“We expect Q3 2021 to continue in the same vein as Q2. Availability of steel will still be on restricted supply, and allocation of finished goods and delivery will be on extended lead times and be at times quite ‘bumpy’!

“Prices will remain at historically high levels in the medium-term, and with other building materials having had further recent price increases, will steel prices rise again? Demand from heavy users of steel in the automotive sector is adding fuel to the fire.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

t: 01453 521 621

e: enquiries@bmbi.co.uk

Visit Supplier's page

Latest news

29th April 2025

Senior pledges to ‘bee’ part of the solution with new biodiversity initiative

Senior Architectural Systems has installed its first on-site beehive, marking another step forward in its commitment to sustainability and biodiversity.

Posted in Articles, Building Industry News, Building Products & Structures, Building Services, Curtain Walling, Doors, Glass, Glazing, Innovations & New Products, news, Restoration & Refurbishment, Retrofit & Renovation, Sustainability & Energy Efficiency, Walls, Windows

29th April 2025

West Fraser range delivering key benefits for South-East carpentry company

An experienced carpenter and building site manager who has recently set up his own company is using high performance panel products from the West Fraser range.

Posted in Articles, Building Industry News, Building Products & Structures, Building Systems, Case Studies, Garden, Restoration & Refurbishment, Retrofit & Renovation, Sustainability & Energy Efficiency, Timber Buildings and Timber Products

29th April 2025

CPD Courses Available Online From Ecological Building Systems

Ecological Building Systems, a leading supplier of natural building products for sustainable construction, has revealed its comprehensive CPD programme for the year ahead.

Posted in Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Continuing Professional Development (CPD's), Information Technology, Innovations & New Products, Insulation, Restoration & Refurbishment, Retrofit & Renovation, Seminars, Sustainability & Energy Efficiency, Training, Walls, Waste Management & Recycling

29th April 2025

WindowBASE launches new prospect databases at FIT Show

Visit WindowBASE at the FIT Show to see first-hand how it helps companies find new customers – the company is launching an easy-to-use, intuitive platform on Stand G16 at the NEC Birmingham from 29th April – 1st May.

Posted in Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Doors, Exhibitions and Conferences, Glass, Glazing, Information Technology, Innovations & New Products, Posts, Publications, Research & Materials Testing, Restoration & Refurbishment, Retrofit & Renovation, Windows

Sign up:

Sign up: