BMBI: Value sales in first two months were -3.4% down

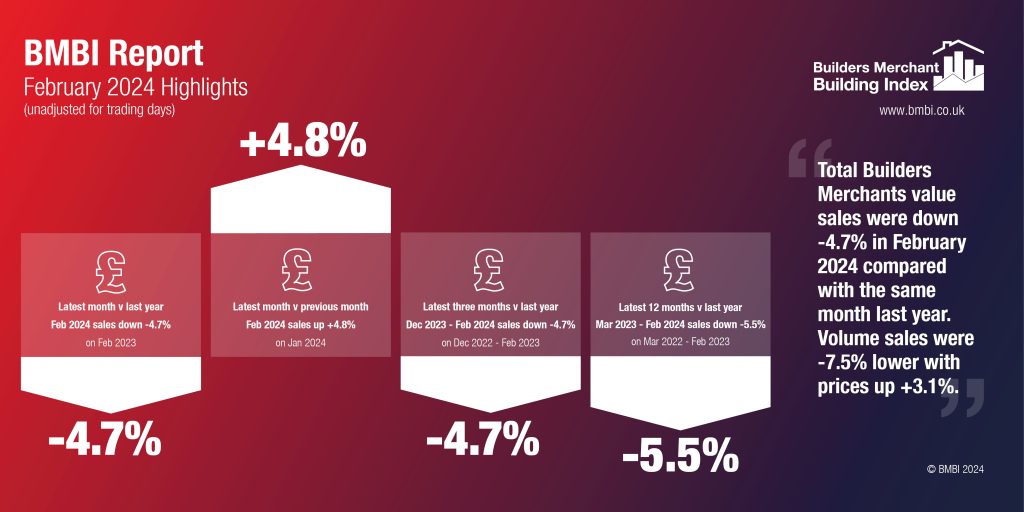

The latest Builders Merchant Building Index (BMBI) report shows builders’ merchants’ value sales were down -4.7% in February compared to the same month a year ago. Volume sales dropped -7.5%, while prices increased +3.1%. With an extra trading day this year, like-for-like sales were down -9.2%.

Year-on-Year

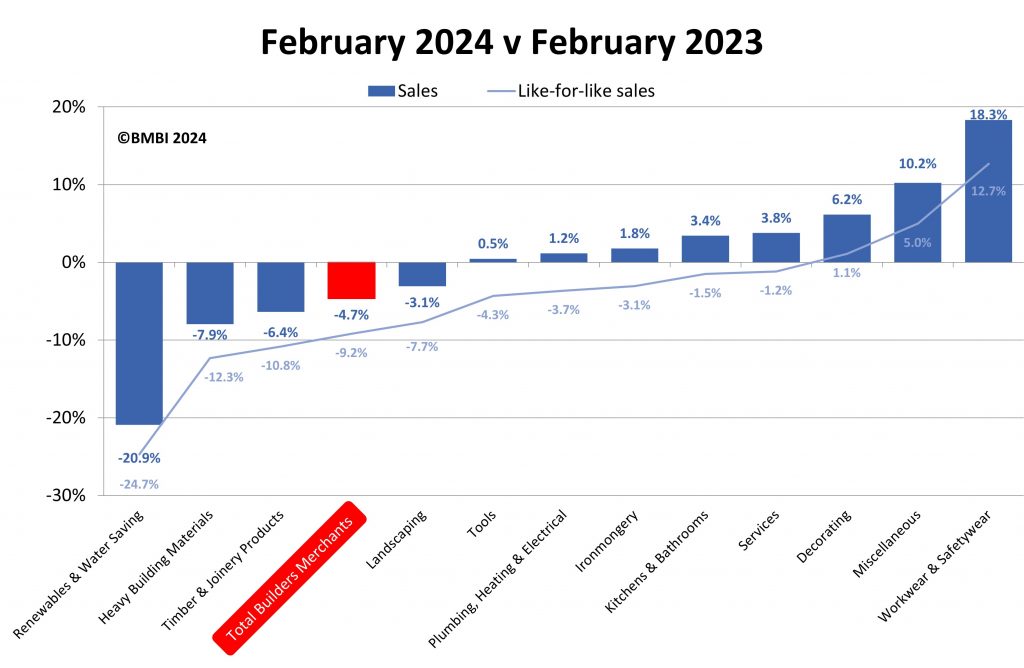

Compared to February 2023, eight of the twelve categories sold more than February 2023 with Workwear & Safetywear (+18.3%) the leading category. Miscellaneous (+10.2%) and Decorating (+6.2%) also did better than merchants overall. But two of the largest categories – Timber & Joinery Products (-6.4%) and Heavy Building Materials (-7.9%) – were down. Renewables & Water Saving (-20.9%) was the weakest category.

Month-on-Month

However, total value sales increased +4.8% compared to January 2024. Volume sales increased +8.1% and prices were down -3.1%. With one less trading day in February, like-for-like sales were up +9.7%. Eight of the categories sold more month-on-month with Landscaping (+17.0%) well ahead of the rest. Heavy Building Materials (+5.8%) and two small categories, Renewables & Water Saving (+7.1%) and Services (+6.6%), did better than total merchants. Plumbing Heating & Electrical (-2.1%) and Workwear & Safetywear (-4.2%) were the worst performers.

Rolling 12 months

Total merchant sales in the 12 months March 2023 to February 2024 were -5.5% lower than the same period the year before (March 2022 to February 2023). Volume sales were -12.5% lower and prices were up +8.0%. With an additional three trading days in the most recent 12-month period, like-for-like sales were down -6.7%. The three largest categories – Heavy Building Materials (-4.8%), Landscaping (-10.4%) and Timber & Joinery Products (-13.3%) – all sold less.

Krystal Williams, Managing Director at Pavestone and BMBI’s Expert for Natural Stone & Porcelain Paving, comments: “Most people in the industry were upbeat about prospects for 2024, however, much of this optimism has dissipated as escalating tensions in the Middle East are negatively impacting our industry’s supply chain.

“Houthi rebel attacks on cargo ships in the Red Sea – part of the main shipping route from Asia to Europe – mean that getting Indian sandstone and porcelain to the UK is being delayed as safer routes take longer. When those ships arrive in Europe, port congestion is again becoming an issue, making it difficult to predict when stock will arrive.

“To add to the challenges, shipping costs have gone up fivefold (at the time of writing) from $600 to $3000 per container. Price increases to cover the additional transport costs are looking inevitable.

Panic buying

“To get ahead of availability issues and price increases, some merchants are panic buying stock. We know from the COVID years that this only leads to further scarcity, additional price increases and merchants ending up with an excess of stock on the ground. We aren’t accepting orders above normal levels or new customers while availability is an issue, but we know other suppliers are.

“Pavestone source most of our porcelain and printed products from Europe, so there is still plenty of product available to merchants. It’s entry level Indian porcelain and sandstone which look likely to have limited availability – or until the political unrest reaches a resolution. The thinner 16mm porcelain slabs are also only available from India.

“Despite the geopolitical impact on the supply chain, we are still hoping for a good 2024. Greige and other neutral toned paving is overtaking dark grey paving as the most popular choice for customers and is certainly our hot tip for those looking to offer something new to entice customers in.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk

t: 01453 521 621

e: enquiries@bmbi.co.uk

Visit Supplier's page

Latest news

28th April 2025

Nuaire first UK ventilation manufacturer to use low carbon-emissions recycled & renewably produced steel

Nuaire has announced that its Magnelis® steel based ventilations systems are now being made from XCarb® recycled and renewably produced steel.

Posted in Air Conditioning, Articles, Building Industry News, Building Products & Structures, Building Services, Building Systems, Heating, Ventilation and Air Conditioning - HVAC, Restoration & Refurbishment, Retrofit & Renovation, Steel and Structural Frames, Sustainability & Energy Efficiency, Waste Management & Recycling

28th April 2025

Renderplas: Builders avoid costly remedial work with PVCu render beads

A pioneer of PVCu render beads, Renderplas is helping the construction industry avoid the costly remedial work associated with rusting steel designs…

Posted in Articles, Building Industry News, Building Products & Structures, Building Services, Building Systems, Facades, Posts, Render, Restoration & Refurbishment, Retrofit & Renovation, Sustainability & Energy Efficiency, Walls

28th April 2025

How Celotex’s Technical Team adds value through expert insulation support

From U-value calculations to real-world installation support, Celotex’s technical team helps construction professionals specify and install insulation with confidence…

Posted in Articles, Building Industry News, Building Products & Structures, Building Services, Insulation, Research & Materials Testing, Restoration & Refurbishment, Retrofit & Renovation, Sustainability & Energy Efficiency, Walls

28th April 2025

Ideal Heating Commercial takes extra care with the heat network at Huddersfield specialist housing development

Ideal Heating Commercial POD Heat Interface Units (HIUs) and Evomax 2 condensing boilers have been installed into Ash View Extra Care in Huddersfield.

Posted in Articles, Building Industry News, Building Products & Structures, Building Services, Case Studies, Facility Management & Building Services, Heating Systems, Controls and Management, Heating, Ventilation and Air Conditioning - HVAC, Pipes & Fittings, Plumbing, Restoration & Refurbishment, Retrofit & Renovation

Sign up:

Sign up: